Evidence suggests that many talented workers are restless. High proportions of the workforce are unsure whether their current position can see them through the cost of living crisis. Meanwhile, with an eye on the future, ambitious employees need reassurance that their work offers genuine scope for career advancement.

Employers can and should respond proactively to these concerns. And whether it’s taking the pain out of reclaiming personal expenses, making rewards schemes more accessible or easing the burden on payroll staff (among other areas), embedded finance can play a valuable role in that response.

The targeted deployment of new financial services capabilities can provide a real boost to your employer value proposition, thereby enhancing your ability to attract and retain talent. To see what this means in practice, here’s a closer look at what’s possible…

What do employees want in 2023?

There’s no escaping the fact that this year is a tough one for employees. High inflation means a loss in purchasing power, which leads inevitably to lots of workers having to find ways to make their income stretch further.

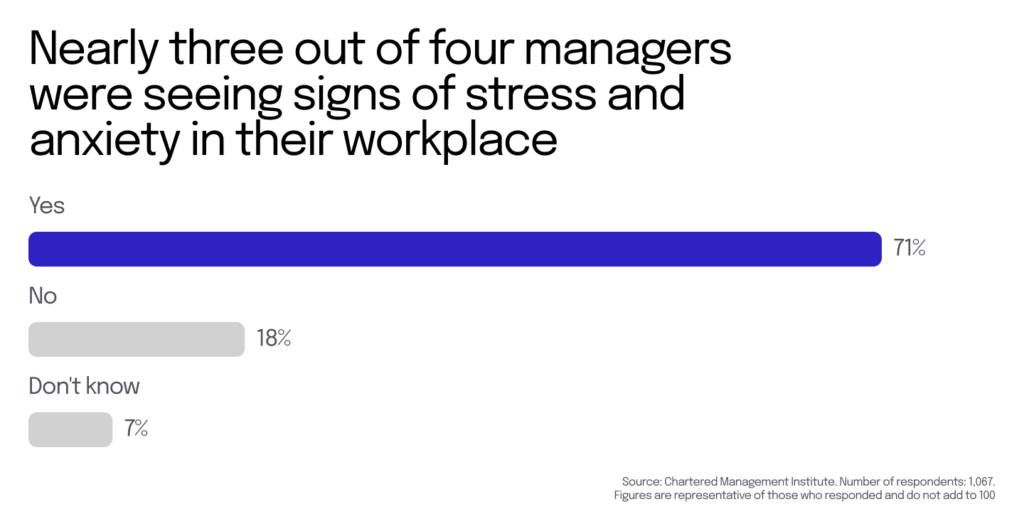

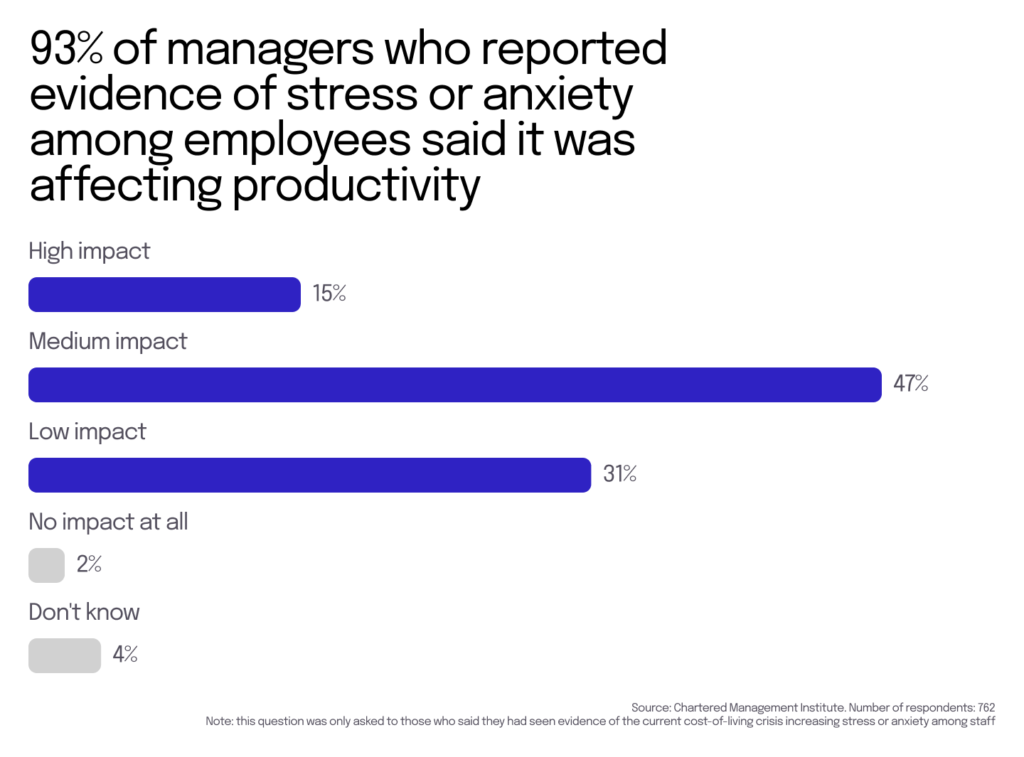

This isn’t an issue that employees can easily leave outside the office door. A recent CMI survey of more than 1,000 UK managers found that 71% had seen evidence of the crisis increasing stress and anxiety among their teams. Of those, 93% had seen a drop-off in productivity, including less focus, increased sick leave, and a reluctance to take on extra work.

As a rule, employees are reluctant to change jobs when the economy is uncertain. However, that rule just doesn’t seem to apply as much to the current downturn. What’s remarkable is just how tight the labour market continues to be, with many firms continuing to struggle to fill vacancies. Project management specialists, ClickUp, found that a quarter of UK employees are considering a move, rising to as high as 39% in particularly in-demand sectors such as IT and hospitality. So when it comes to talent, it’s still very much a seller’s market; something that employees are ready and willing to leverage.

But what about longer-term employee goals (i.e. the “Where do you see yourself in five years time?” question)? LinkedIn’s recent Skills Advantage Report casts a light on worker attitudes. The survey shows that employees are all too aware of the ways in which jobs are changing, and of the need to future-proof their careers. In areas such as HR, finance and customer service, workers want to stretch their capabilities. Instead of being bogged down in a mountain of transactional tasks, those workers want the opportunity to add value to the business, and enhance their employability. If this isn’t on offer from a particular employer, existing staff and new recruits are much more likely to look elsewhere.

So in summary, employees in 2023 want support in the face of the cost of living crisis (tip: as we’ll see, this isn’t just about pay rises*). And with an eye on the longer term, they want the potential to move away from form filling and number crunching to bring added value to the business.

*We spoke with Luke Fisher, CEO of Mo on this very topic in recent webinar, here’s a snippet of what he had to say when chatting to Daniel Greiller, CCO of Weavr.

Embedded finance as a relationship enhancer

On a technical level, that term, Embedded Finance refers to the “placing of a financial product in a non-financial experience, journey, or platform.”

On a more fundamental level, what embedded finance is really about is building or strengthening particular types of relationships, by integrating new financial service capabilities into the platforms that organisations use to manage those relationships. This is most obvious with customer-facing applications. Whether those businesses provide it through preloaded payment cards, digital wallets, one-click purchasing – even business lending arrangements – (among a host of other capabilities), embedded finance is deployed to iron out the niggles that can exist in that relationship, particularly around things like convenience, speed of service and managing spend.

What’s more, once you start exploring the potential of this type of tool for employee-directed applications, you see how the same relationship enhancing benefits exist here, too. The core aim of many customer-facing embedded finance projects is to boost “stickiness”: to remove the incentives for customers to leave your ecosystem (an app, website or piece of software), because everything they need is right there. Likewise, get it right, and embedded finance integrated into employee-facing platforms can help you address exactly the type of concerns, priorities and ambitions relevant to your workforce, thereby reducing the likelihood of staff attrition.

Acting smart with rewards

Many firms find themselves able to offer some kind of pay rise (around four to seven percent, on average). For the majority however, inflation-busting hikes (i.e. ten percent or above) are simply not viable.

Acting smart with rewards means looking beyond basic salary to see what can be done with the wider package. Alongside – or in lieu of – basic pay awards, embedded finance solutions can make it easier to roll out new perks and benefits to your platform. One example is a system of branded benefit cards and performance-related rewards, whereby employees can take their pick of perks, products or services from a menu of approved providers. It’s flexible, easy to administer, cost-effective, and enables employees to effectively tailor their own benefits package to reflect their preferences.

Delivering on autonomy and added value

In the current climate especially, staff do not need the hassle of having to jump through administrative hoops and face delays on routine sign-offs on expenses. Part of the solution to this could include instant digital accounts and payment cards. They helps give greater autonomy to employees by empowering them to spend safely, and in the knowledge that they will be reimbursed rapidly.

When integrated seamlessly into employee-facing platforms, embedded finance not only enhances the employer brand proposition, but can also remove whole swathes of line-by-line admin for your end users’ back-office functions (particularly finance, HR and departmental managers). Less time on processing means more time for value-added work: i.e. precisely what employees want to see more of to future-proof their careers.

Find out more

For a more detailed exploration of the potential of embedded finance for staff recruitment and reducing employee churn, access our guide, Digitally empowered employees: the financial dimension.

To see the difference a flexible, all-in-one employee benefits platform can make on the ground, check out this case study with, Ben.