How open banking and banking-as-a-service are complementary bedfellows for embedded finance.

If you’re building any kind of financial product you’ve likely heard of ‘open banking’. In the last few years, it’s seen a huge increase in support from the finance industry – especially as new regulation in Europe has pushed traditional financial institutions to embrace adoption. And the more open banking is explored, the more its place in the toolset needed to power to shape embedded finance is coming into focus.

What is open banking?

Open banking is still fairly new and not everyone in the finance world has been quick to embrace it. But that’s changing, and regulation is the forcing function enabling its existence.

Beyond the UK, you can more or less substitute the term open banking for the revised Payment Services Directive (PSD2), the EU regulation which requires financial institutions to allow access to financial data with the aim of enabling innovation and thereby providing better outcomes to end customers. This Fintech Times article explains more about PSD2 and how it shapes technology.

In the simplest terms, open banking is a framework that gives end users the power to take control of their own financial data. That access means they also have the ability to share their data however they want with third parties, which opens the door for embedders to offer new features and financial services that wouldn’t otherwise be possible. Open banking provides the power to access and analyse the data in a customer’s financial account and the means to initiate payments from that account on behalf of the customer.

The first waves of innovation

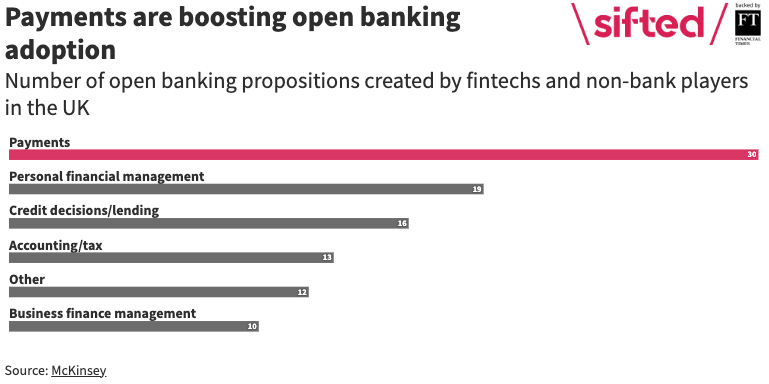

The first platforms using open banking essentially offered a portal. Consumers could go in to collect information about their various bank accounts and see everything in one place. Then Payment Initiation Service Providers (PISPs) like Openpay enabled retailers to make payments directly from your account on your behalf, to help customers with things like saving and investing.

Now open banking presents a way for customers to use that data overview to decide what to do with their money. For example, there’s a clear link between open banking and wealth management applications. In such apps, users can track all their transactions clearly and easily, buy shares with instant transfers, and businesses can use the data they see to tailor new features, like money pots to encourage more saving.

What makes open banking so useful for embedders and customers is that encourages innovative thinking just like the App Store encouraged developers everywhere to create all sorts of apps. When Apple launched it they could have made it a closed system, with only apps made by their developers allowed on there. But instead, it was opened up to third parties, which meant developers could build innovative new apps and users could find almost any solution they needed.

Open banking is similar in the way it fosters innovation. By allowing access to financial data through APIs, it gives embedders a chance to bring financial services into their products and build useful functionality that enhances their offering. And like the App Store’s review process and developer policies, confidence is part of the framework. A consumer’s financial data isn’t open for everyone to see – users can decide how the APIs use their data, and the Open Banking system provides a secure framework for sharing financial data through APIs, ensuring that users have control over their data and that it is used only for authorised purposes by authorised parties.

Open banking certainly doesn’t hold all the answers for the unification of digital and finance. It also has its detractors, one such detractor is Anne Boden CEO of Starling Bank who branded open banking as a flop that’s too costly, “clunky” and said businesses struggle to make money from it.

Weavr Co-Founder and CEO, Alex Mifsud argues that Boden’s comments were premature.

“Open banking is a foundational idea which will take longer to have an impact than its original boosters have predicted but will in time be far more disruptive than many expected,” Mifsud told Verdict.

Open banking and embedded finance: what’s the link?

The core functionality of open banking is about sharing information and making payments. But it’s not seamless: data needs to jump from an app to a bank and back to an app, dragging payments along behind it. Say you have a credit card and you opt to pay your balance by bank transfer. Your card provider might indicate the banks they have integrations with and, when you select your own, you’re pushed to your bank app. The experience is split between your card app and your banking app. It’s not at all seamless.

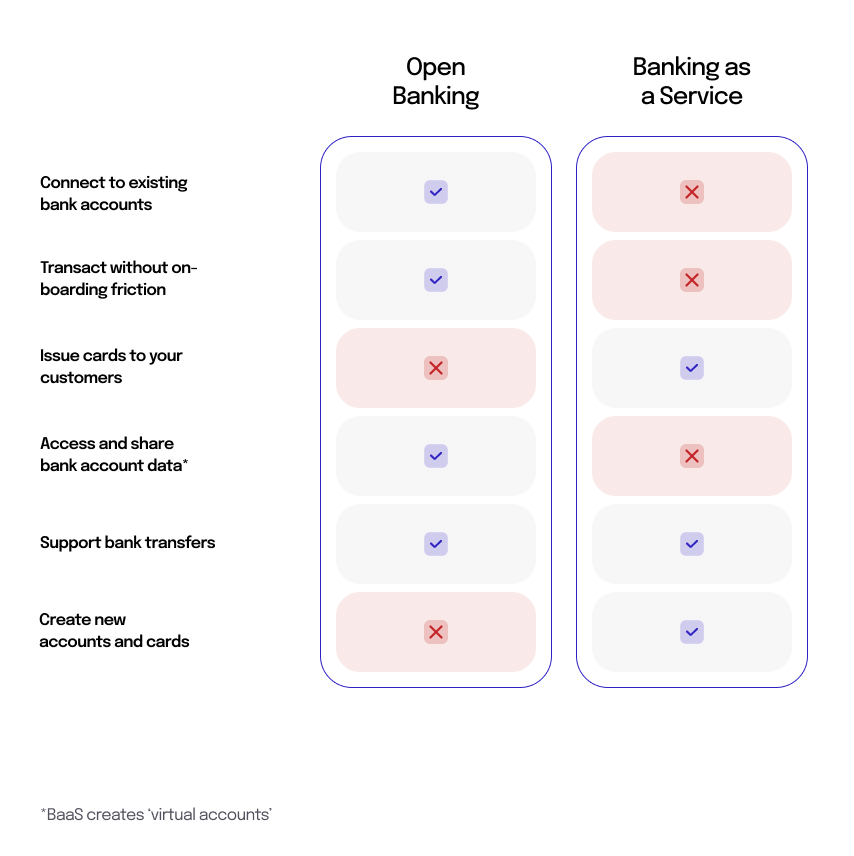

The core issue is that open banking can only deal with bank and payment accounts that already exist – it can’t create accounts or financial services by itself, and that’s where embedded finance offers much greater capabilities. The possibilities of embedded finance are limited by the creativity of the embedder, whereas with open banking they’re limited to reading financial data and making bank transfers.

While open banking creates a greater level of interaction with traditional bank accounts, embedded finance can create entirely new virtual accounts. While perhaps a little reductive, if open banking is ‘read’, embedded finance is ‘read-write’.

These virtual accounts – just one type of financial service banking as a service makes available – can be added seamlessly into software (websites, apps and more). Hence, it’s a unified brand experience for the customer. Embedded finance is the other half of the puzzle that takes the power held by traditional financial institutions and puts it in the hands of brands and their users.

For embedders, it’s not a case of choosing between banking as a service and open banking – they complement each other, they are not competitors. Embedded finance systems like Weavr already use banking-as-a-service APIs alongside open banking suppliers to get money onto platforms, and as such is more powerful and in some instances it can be quicker and cheaper for embedders than banking-as-a-service alone.

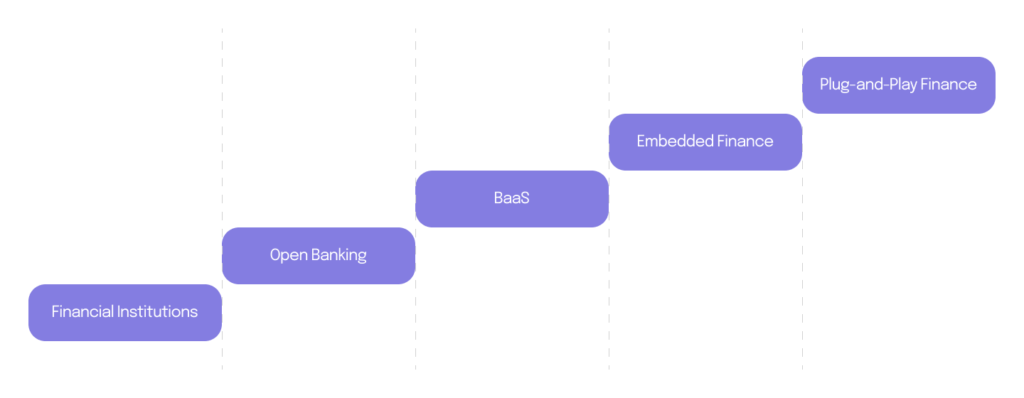

Embedded finance creates opportunities that literally ‘embed’ banking options into the platform of non-financial companies. And these banking options are mutually beneficial to all parties, including the consumer who doesn’t have to jump through a few hoops to make the payment. This sort of cross-pollination with third parties is also what open banking and BaaS bring to the table, albeit in differing forms, but with the shared outcome of evolving the traditional [1]. As you can see from the below table, the next step up in this financial development is Plug-and-Play Finance, Alex Mifsud, Co-Founder and CEO of Weavr describes it here:

“…avoids the complexity of building banking-grade solutions: a Plug-and-Play Finance solution is simply integrated just like any other piece of software… Plug-and-Play Finance really does represent the future of a digital financial world.” The full article “Plug-and-Play Finance, the next step for embedded finance” can be found here.

Embedded finance and the evolution of Plug-and-Play Finance are leading the charge in bringing finance into non-financial applications and seeking to bring finance to the mainstream of digital businesses.

Empowered embedders can create game-changing financial products. With access to consumer data and a marketplace of embedded financial services, they can tailor their features to what their customers really need and rapidly evolve with them.

A real-life example of an empowered embedder is Ben with their SaaS platform for employee benefits. Embedded finance features integrate seamlessly with their software giving the end user better user experience.

The open banking tide is rising every day

The role of open banking for embedders is still evolving, but it’s clear that it’s part of the roadmap toward making financial services accessible for everyone, wherever they need them. Newcomers offering Banking-as-a-Service and later embedded finance have helped take the hold on those services away from traditional banks.

Open banking’s growth isn’t just the result of new financial regulations. Major tech companies and financial institutions have realised the benefits for customers who want seamless access to more tailored services and control over their data.

As embedders and financial institutions continue to explore the possibilities of open banking, it will likely grow even closer to embedded finance. It already makes sense for them to work together – there are clear common goals in levelling out access to financial services, and providing end users with innovative solutions to problems that have long been overlooked. Ultimately open banking and embedded finance are aiming at the same problem – the democratisation of financial services.

If offered together, it would mean they could help embedders achieve those goals even more quickly and with greater customisation than embedded finance can already enable by itself. With everything condensed down into one place and one integration, open banking and embedded finance can completely change the way embedders look at building financial products.

Whether your offering is an application, marketplace or platform, if you’re looking to embed finance into your business, set up a meeting with one of our experts in your industry and have a chat to understand the opportunities of embedded finance.

[1] Tech HQ.com