Written by Daniel Greiller, CCO of Weavr.

When you think about embedded payments, you’re probably thinking about a one-click checkout. Consumers go online, add goods to their basket, then purchase them without ever going through all the usual shopping cart stages.

Before joining Weavr, I was the same. Amazon filed its 1-Click patent back in 1999, so I didn’t think there was much more new ground for anyone to break by now. But the truth is there’s so much more to embedded payments than helping consumers breeze through their Christmas shopping.

The B2B world is ripe for embedded payment disruption

The majority of people don’t think about payroll as a kind of payment. It’s something that happens in the background – no one sees the wheels turning, they just get their salary at the end of the month.

But for the people involved in sending out those salaries, that’s not the case. They’re all too aware of the process that goes on behind the scenes.

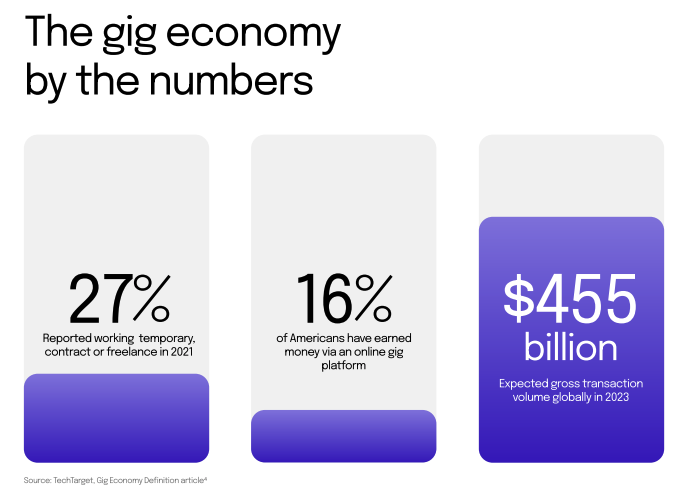

As well as paying employees, they’re also paying out expenses and fulfilling invoices for freelancers and suppliers. Depending on the business they might be making international transfers and sending money either directly into bank accounts and via marketplaces or portals. And that’s before the recent rise of “employer of record” businesses, which added a whole new and extra level of complexity (while providing freedom and opportunity for many companies and individuals around the world!)

Payments are a broad umbrella, and it’s not appropriate to consider only the experience of a consumer online. But while embedded payments have been part of the consumer and retail world for years now, the B2B world is only just starting to see the relevance.

The rise of digital platforms needs a new kind of payment

For consumer apps and merchants, embedded payments are pretty much a solved issue. And that’s largely because innovators in that world have had to chase and provide frictionless solutions in order to survive, today’s digital consumer is an unforgiving soul.

If a consumer finds their ride-hailing or food delivery app too clunky to use, they’ll quickly delete it from their phone and find another. It’s a cut-throat world where something like your payment experience can make the difference between winning the market and being left behind.

But if someone in a back office team has the same problem with their accountancy or HR platform, they’ll probably learn to live with it. The software is essential for them to do their job, so they can’t stop using it altogether simply because the payment experience is frustrating – and at any rate, that decision usually isn’t theirs to make alone.

The reason that’s changing now is because the way we work and interact with these platforms has changed. The rise of a remote, global workforce and the gig economy over the last few years has made payroll a matter of managing multiple geographies, currencies, and taxation systems.

There’s also a greater focus on companies offering more flexible employee benefits (check out Ben, for example), and making those easier to access and redeem.

Against this backdrop, software that uses embedded payments can determine whether an early-stage company can access talent across the world or not.

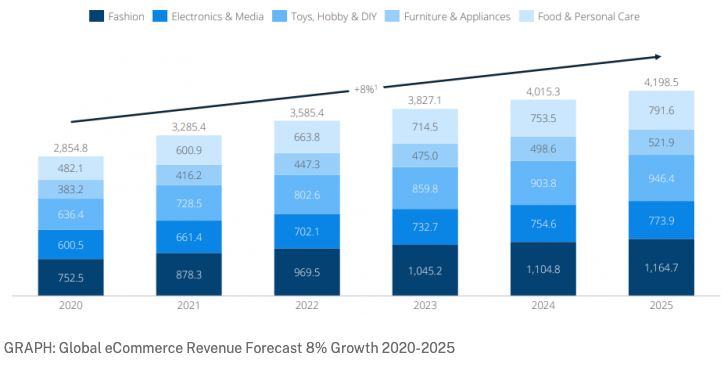

Then there’s the growth of digital platforms. From ERP systems and logistics software to benefits portals and global freelancer marketplaces, there’s been a huge step change in digitisation. And the more these platforms digitise and automate old ways of working, the greater the demand will be for payments to come along for the ride.

Bringing the customer-first mentality to B2B platforms

When you click “buy now” on Amazon or any other retail site, you don’t think about all of the complicated technical processes going on behind the scenes to make that transaction happen. You just notice how quick and easy it was, then go about your day. And that’s really the whole idea.

Embedded payments are all about making payments flow seamlessly, whatever the use case. While that has obvious benefits for the consumer experience, the B2B world is by no means left out. Embedded payments open the door to automating payment flows and reconciliation, allowing many of the tedious manual steps that plague back-office teams to be trimmed out of the process. In order to provide the seamless “retail” experience everyone is used to providers have to achieve:

1 – a wholly integrated/embedded customer experience – never let the user be seen to be leaving your branded interface.

2 – reduction of friction. This isn’t just about the number of screens involved, but also the data being inputted. All information should be pre-populated, or better yet, hidden behind buttons.

3 – effortless authentication. Sorry … you can’t see my face … ?

The impact this can have on B2B platforms is massive. When the people using them every month to sort out suppliers, salaries and expenses can do it all within one system, they aren’t bouncing between multiple browser windows and applications. That frees up more of their time to dedicate to more value-adding areas of their job, or to attend more training.

It also shrinks the opportunity for human error to creep into play, and that’s by no means something to overlook. According to research from Versapay, 80% of c-suite executives at large companies say they’ve lost revenue as a result of miscommunication that led to invoice disputes, and 92% said that digitising the payment process was key to ending the problem.

Embedded payments are now solving problems that have never been solved before, in every sector. Back-office teams aren’t necessarily crying out for more frictionless payment rails, but they are hungry for essential workday tools that are as smooth and easy to use as consumer apps. The brands that can deliver the experience they’re looking for will be the ones that win.

If you’re looking to embed finance into your business, check out our guide to B2B payment processes or set up a meeting with one of our experts in your industry and request a demo.