For a little over 18 months, we’ve been on the mission to enable any business to integrate any financial service anywhere their customers need it. Our Plug-and-Play Finance solutions are the fastest way for a business to do so. With momentum built in Europe, we can’t wait to come to the US next!

If you’re not familiar with Plug-and-Play Finance, let us tell you a little more.

At Weavr, we believe that the world works better when financial services are provided within digital applications. Plug-and-Play Finance is the fastest, easiest and most efficient way for businesses to make that happen. Our CEO, Alex Mifsud, explains it best:

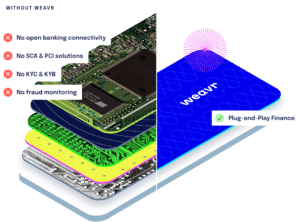

“In the past, industry disruptors, like Uber and Amazon, had no choice but to build their finance integrations from the ground up in what was a costly, complex and time-consuming process. Weavr shortens the time to launch embedded financial solutions from many months, or years, down to weeks or even days, while eliminating the hassle of managing compliance and data security.”

All a business needs to do is Plug and Play – the solutions just work.

How so? The test of whether something is Plug-and-Play Finance is simple. If a business has to understand how it works and take on the responsibility of managing how it operates, then it’s not Plug-and-Play Finance. When all a business has to do is deploy and enjoy, that’s Plug-and-Play Finance.

Unlike traditional banking-as-a-service solutions, which offer a selection of APIs that require clients to invest in time-consuming and technically intensive integrations, Plug-and-Play Finance pre-configures APIs into sophisticated, tailored, embedded-finance solutions that clients deploy out of the box without needing to master— or even concern themselves with – the back-end technology powering them.

Weavr provides everything a business needs to integrate financial services seamlessly into its mobile apps, SaaS applications and other digital properties. Our Plug-and-Play model eliminates the cost and burden of multiple vendor relationships, simplifies compliance, shortens the runway for integration and empowers businesses of all kinds to go to market swiftly and safely.

Weavr helps businesses grow, both globally and in capability

Our solutions are also extensible, which means that customers can add more financial services as their businesses grow, and even add financial providers to power them in new geographies. Indeed, unlike other platforms, the Plug-and-Play technology is open to connect to financial-services providers and vendors in multiple geographies across continents.

Intrigued? Take a look at how some of our innovators use our Plug-and-Play Finance:

ThanksBen, an all-in-one benefits platform for companies, wanted to combine payments infrastructure with a marketplace to provide an innovative solution to employee benefits. Through us, ThanksBen can give employers corporate wallets and card-issuing capabilities so that employees can spend an allotted amount on any number of dynamically connected providers for everything from e-learning to Friday-afternoon drinks. Read more here.

Troc Circle, an invoice-netting company, wanted to leverage Weavr’s virtual-card capabilities to allow its business users to pay out to their suppliers and, at the same time, collect their receivables through the Troc Circle platform. With Weavr, they can do that without needing to jump through compliance and regulatory hoops for each country as the burden is handled on our end instead of theirs. Read more here.

If you haven’t already, don’t forget to join the waitlist to hear about our US launch!