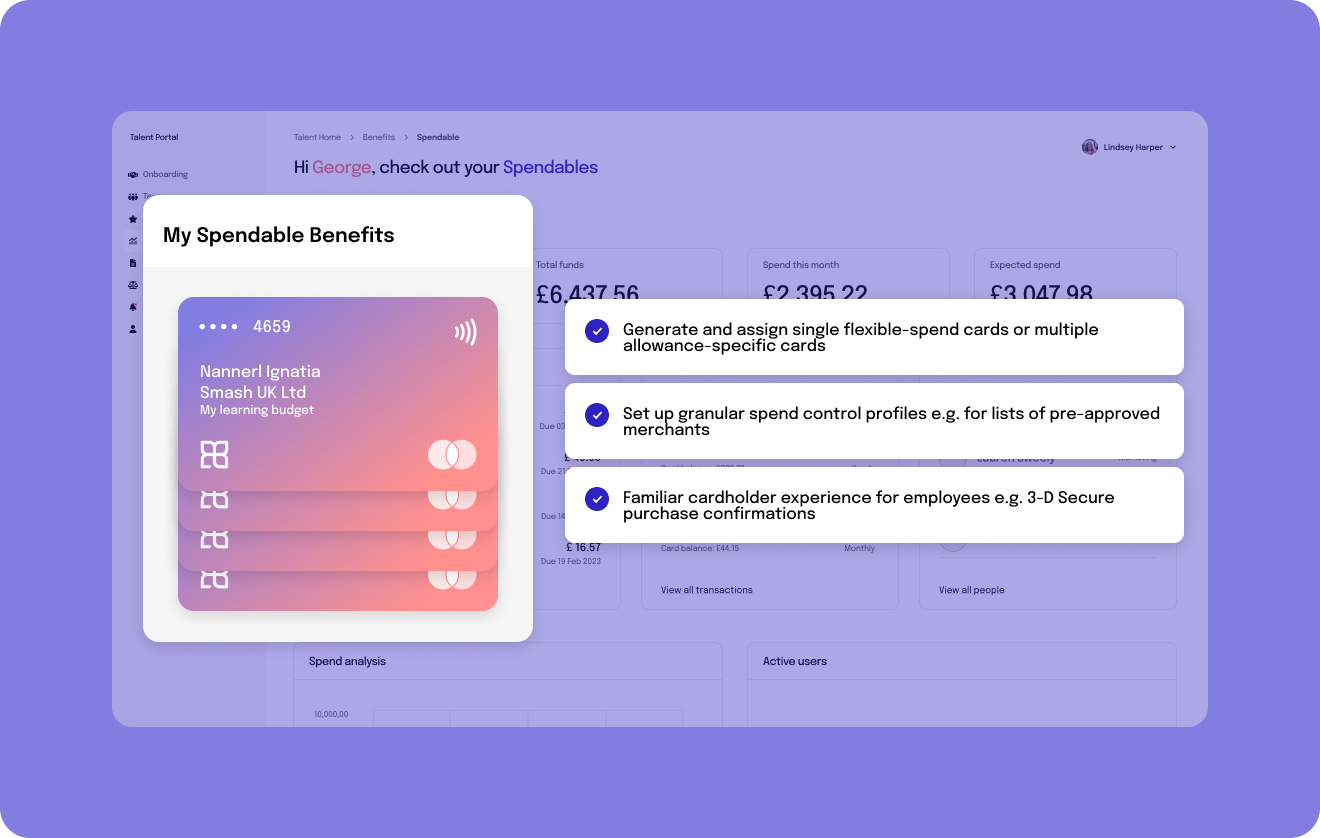

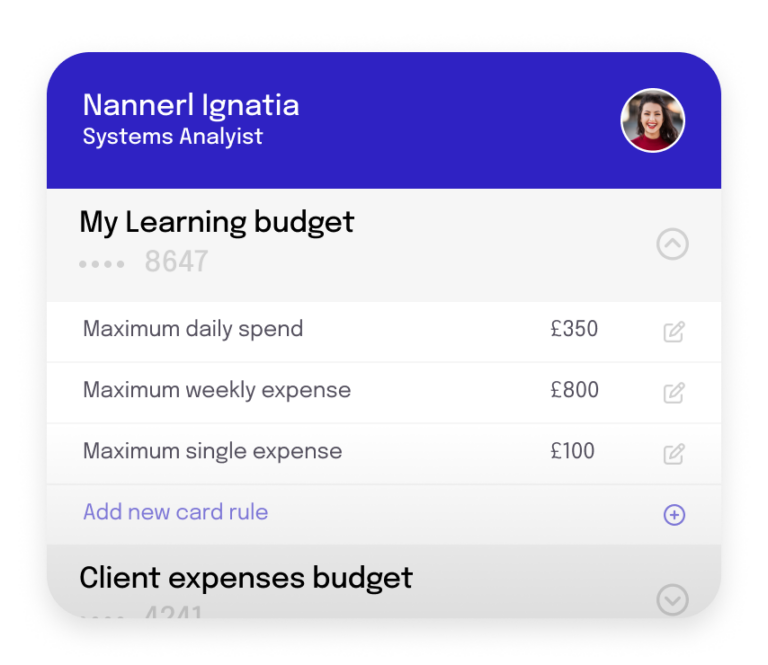

Benefits programme managers

- Allocate benefits packages based on spend-controlled cards for each employee

- Add new ideas or adjust rules and budgets at any time

- Define new benefits in terms of spend-controlled allowance

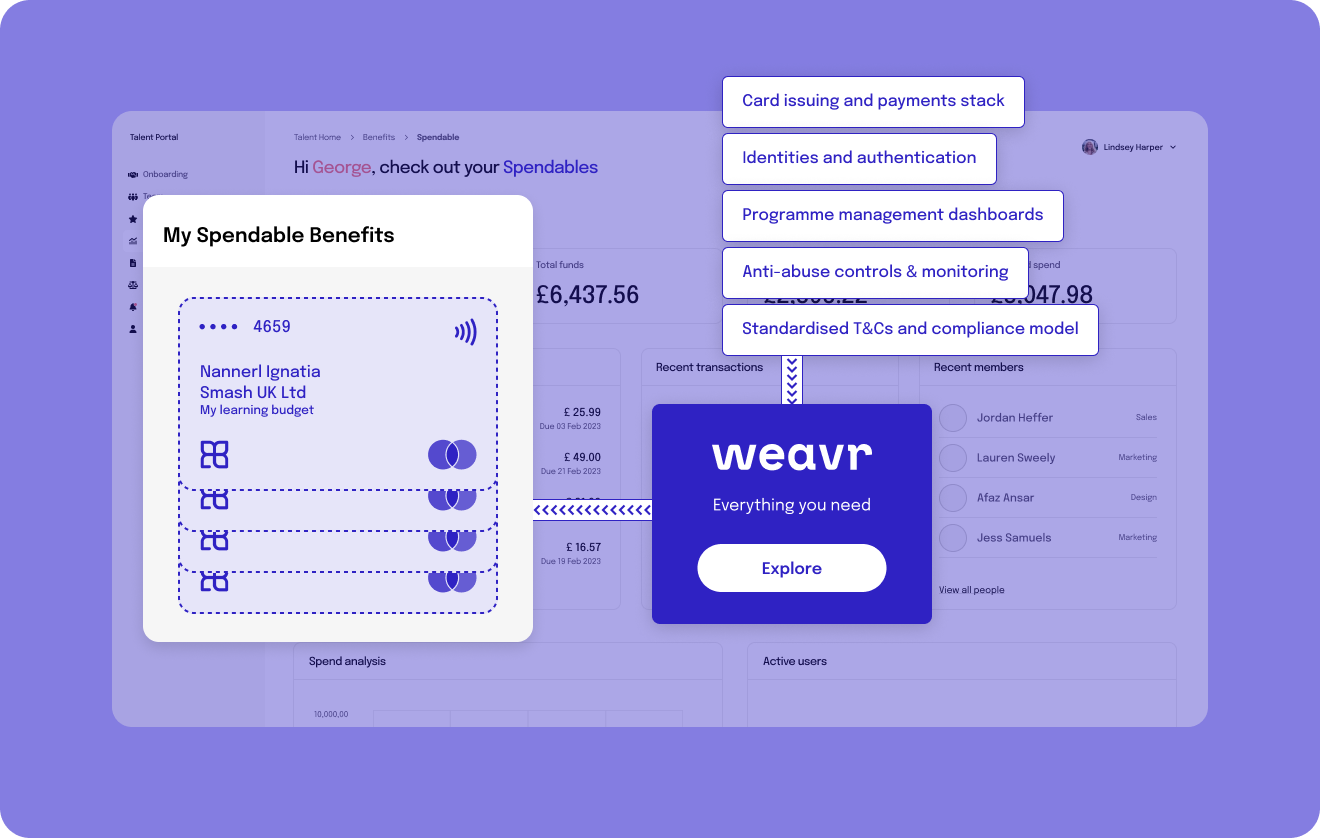

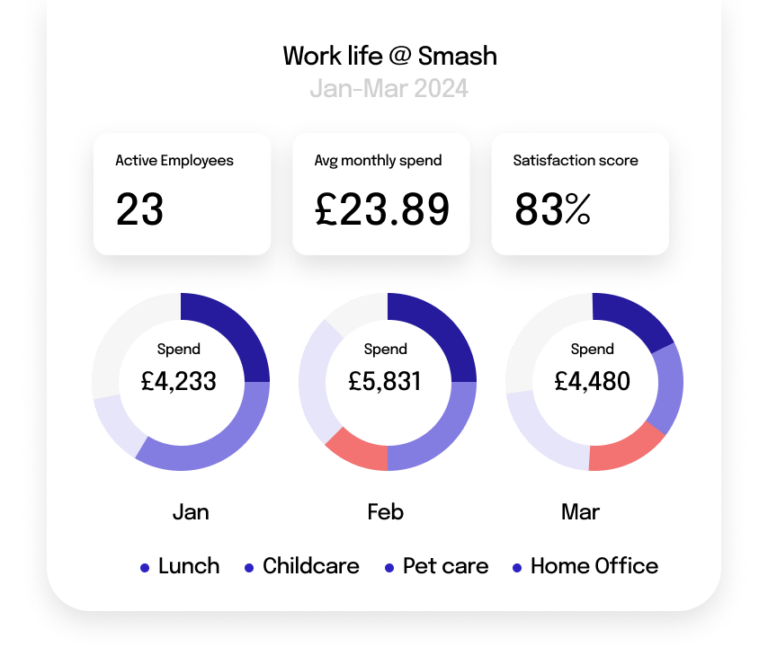

Financial controllers

- Define and manage budget pools for employee benefits

- Supervise spend rules in templates and in live employee usage

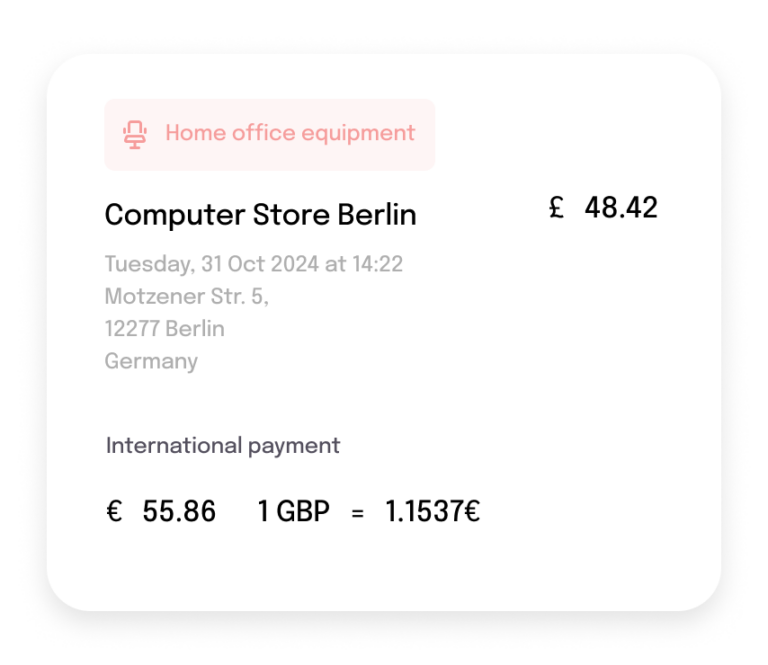

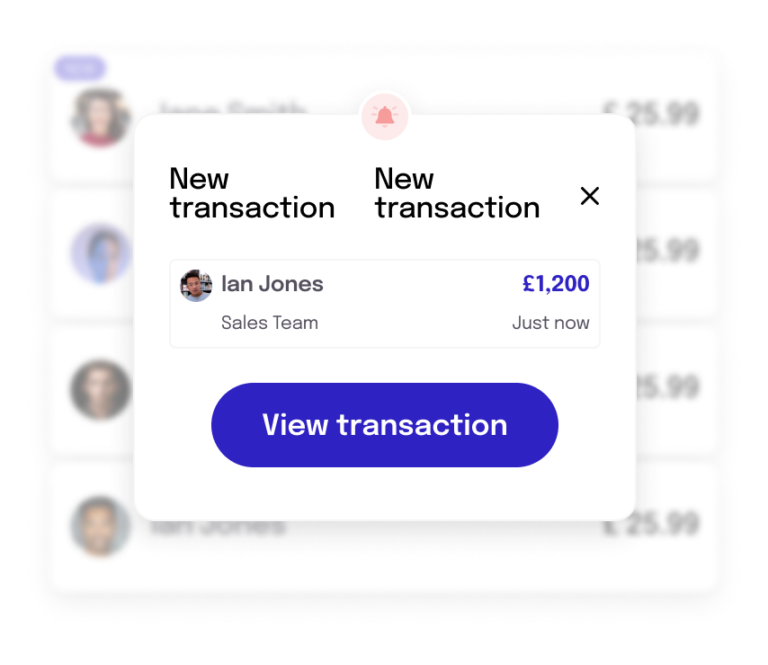

- Work with live, on-demand transaction data

Employees

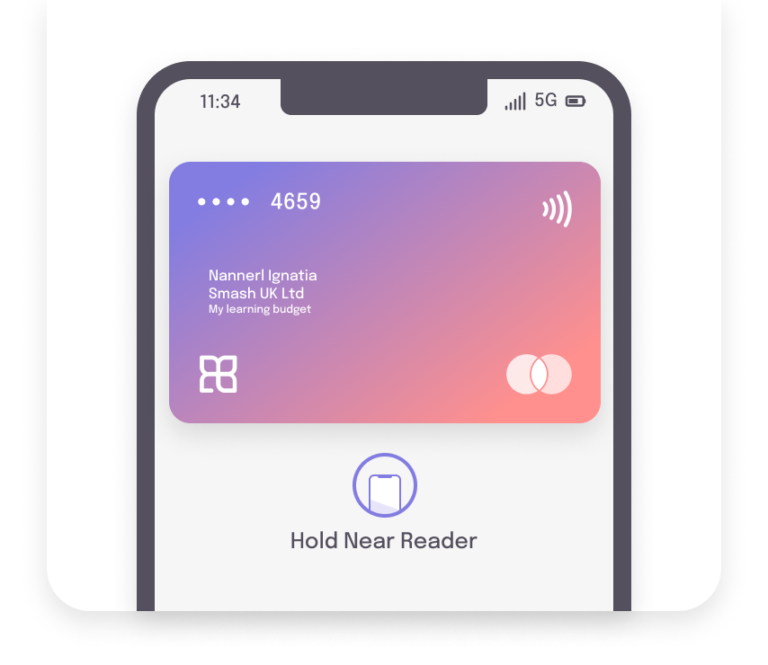

- Enjoy spendable benefits, feeling more recognised and connected to the employer

- Manage purchases and cards in a familiar UX, all within the existing employee app/portal

- Check allowances and rules easily without worrying about going outside policy or being out of pocket