- Introduction

- How embedded finance can 2X your revenue

- How much money is in embedded finance?

- Who makes money from embedded finance?

- How does embedded finance make money for embedders and platforms?

- How embedded finance helps growth

- How embedded finance helps monetisation of your product

- How embedded finance helps increase customer loyalty

- How embedded finance creates transactional revenue

- Breakout strategies become possible

- How much revenue/ money could embedded finance make a platform?

- Conclusion

Embedded finance is changing the face of software and perhaps we’re preaching to the converted here, but let’s pretend you’re talking to stakeholders in your organisation that don’t know or care what “embedded finance” means… yet. In this guide, we will be looking at the various ways embedded finance can help to make you money.

For the purpose of this guide, we assume your colleagues and your higher-ups are not interested in the details of the technology behind embedded finance. They aren’t closely involved in designing the customer experience of your application or in solving the breakpoints in UX that embedded finance seeks to join back together. And so far they haven’t seen enough signs that embedded finance is a common competitive theme altering the landscape of your sector within the next few years.

Our Weavr experts, George Baily, Joaquim Marques, and Marcus Vernon got together to discuss ‘Increasing SaaS revenue with embedded finance’. You can watch it here before you check out the rest of the guide 👇

When talking to colleagues and stakeholders about embedding financial features in your product, let’s assume they are not intrinsically excited by innovation without something more concrete to prioritise.

They only have one question: where is the money? If innovation ideas aren’t seen as impacting the bottom line, they are not going to get airtime. So if you are talking about your embedded finance in your product roadmap, they’re likely to ask: how do we make money with embedded finance?

Good news. We’ll answer this question and more in this guide.

We’re going to assume you have a little understanding about embedded finance already. So if you’re not certain what embedded finance is a) we empathise and b) you should check out our ultimate guide to embedded finance (it’s a good long read).

Psst! Do you want a more visual, high-level overview of how embedded finance boosts revenue for SaaS products like yours? Check out the “How embedded finance makes you money, a visual summary” section below.

“Embedded finance multiplies your revenue by two” – is the hype real?

If you’ve ever met someone who gets embedded finance, and especially if that person was a sales representative, they might have told you something like this:

“If you think your SaaS business is already a disruptor, just wait: embedded finance could be the fuel your growth engine has been begging for.

It soups up customer acquisition and drives retention through the roof. And there’s up to a 2x revenue multiplier on the table.”

They might use words like rocket fuel or turbo charge and it’s very clear they’re excited about it. After all, anything that can multiply revenue by two times or more is worth getting excited about. But is that figure for real?

Well, as we’ll explore, a 2x revenue multiplier is actually the base of what you’ll calculate in our SaaS uplift calculator model (more on this later), even without interchange. And interchange financial fees can count for a lot too.

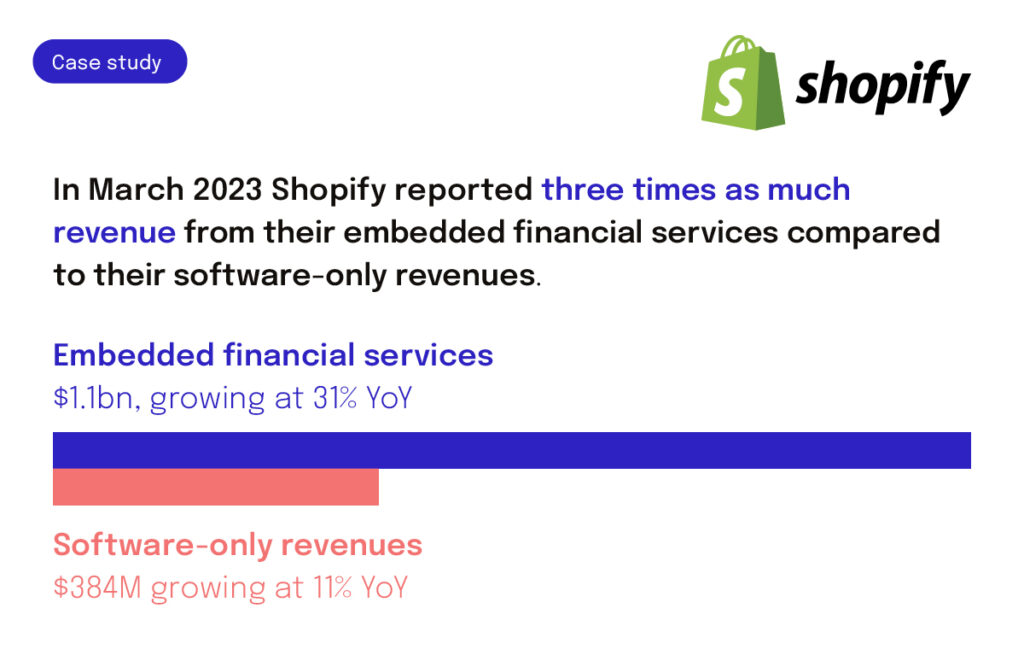

Consider the case of Shopify: in March 2023 they reported three times as much revenue from their embedded financial services ($1.1bn, growing at 31% YoY) compared to their software-only revenues ($384M growing at 11% YoY). That’s an astronomical difference, I’m sure you’d agree.

Maybe you’ve heard this before. Maybe an embedded finance salesperson put this question to you: if you’re only seeing software-only revenues, why wouldn’t you want to be like Shopify and potentially see more than two times as much?

But, you might ask, is it just a few giants like Shopify that can make this kind of revenue? What about our own much smaller platform? What if we’re at a far earlier growth stage? These are fair questions, so let’s look at what kind of money is on the table in the wider market.

How much money is in embedded finance?

There’s plenty of money in embedded finance based on the simple fact that embedded finance is becoming a significant way for money to transfer hands.

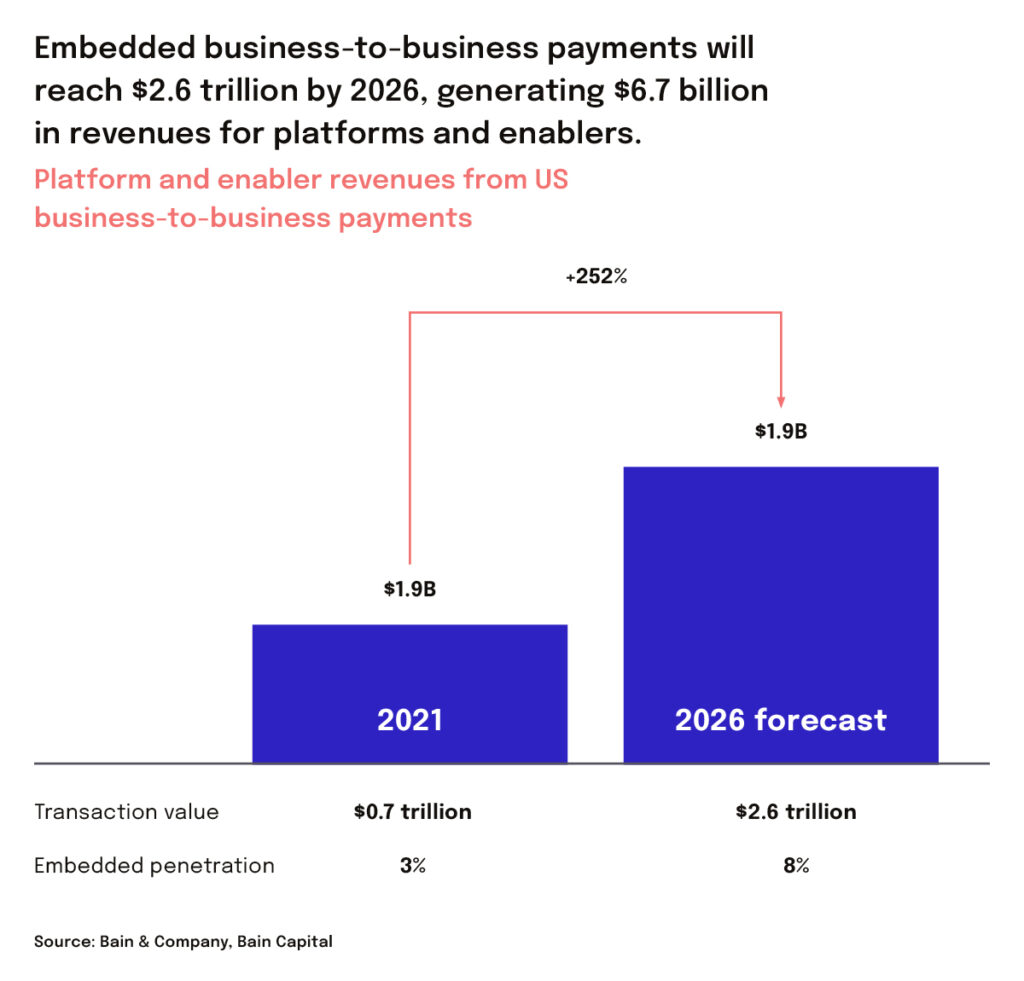

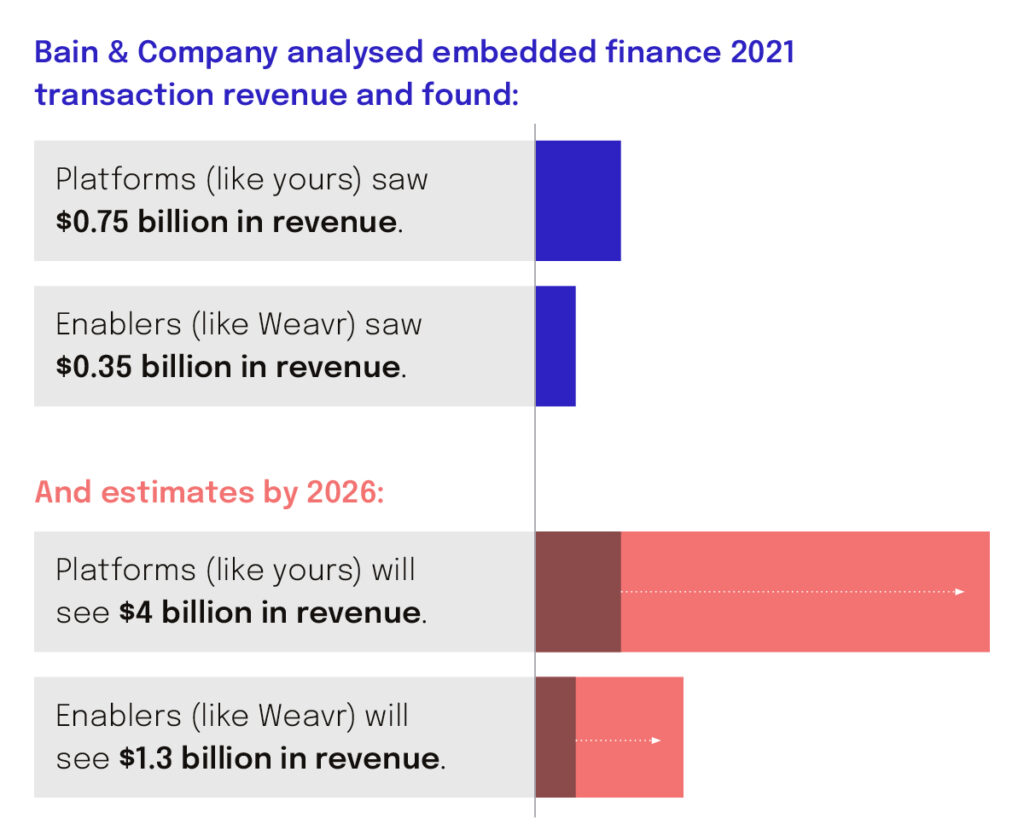

According to the consultancy Bain & Co. financial services in e-commerce and other software platforms accounted for 5% of United States financial transactions in 2021. By 2026, these embedded finance transactions are expected to be 10% of the total value of transactions in the United States That’s roughly $7 trillion in the United States alone.

In B2B payments, embedded finance transactions in the United States will account for $2.6 trillion, up from $0.7 trillion in 2021.

Of course, that’s just the United States. When you consider what those totals look like from a global perspective, the money involved is staggering. Needless to say, everyone wants to at least have table stakes in this transition, and nowhere is that clearer than in the investment data.

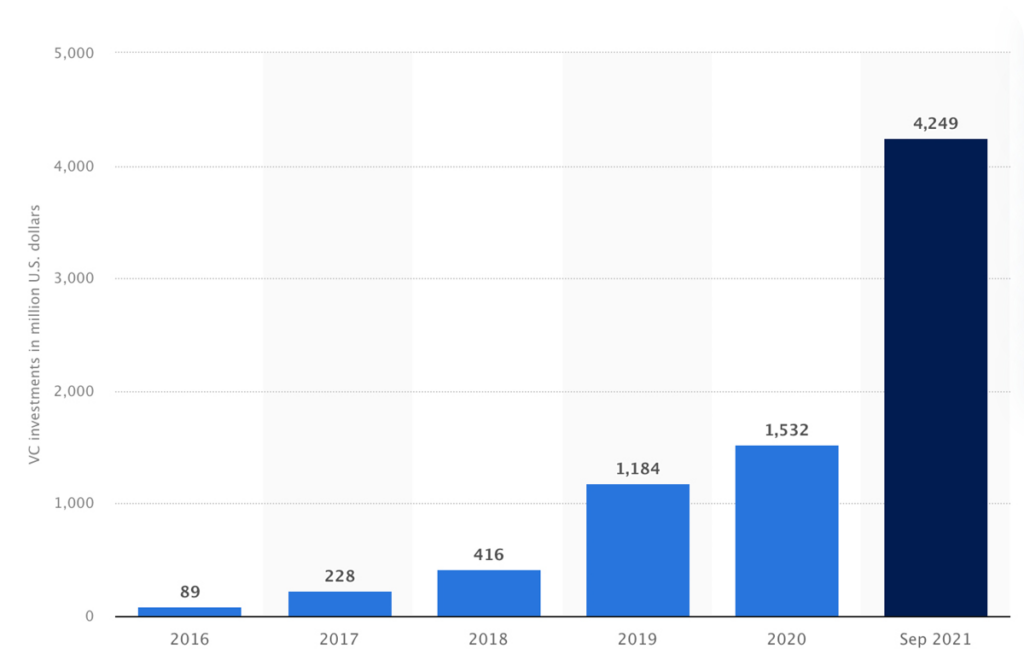

In 2023, Statista’s Research Department made clear just how much investment was on the rise: in 2020, $1.5 million of venture capital was invested in embedded finance. By September 2021, this figure had risen to $4.2 million.

Value of venture capital (VC) investments in embedded finance from 2016 to 2021 (in million U.S. dollars)

It’s not likely to slow down, even in a tough economic climate. As Insider Intelligence report, investment in embedded finance is proving to be upbeat in the United Kingdom, even as fintech investment drops 8% year over year, and drops 30% globally.

Clearly embedded finance is set to make people money – but the question is: do you stand to benefit? Will platform holders and embedders using the technology see this revenue themselves? Or will it just be investors and embedded finance providers?

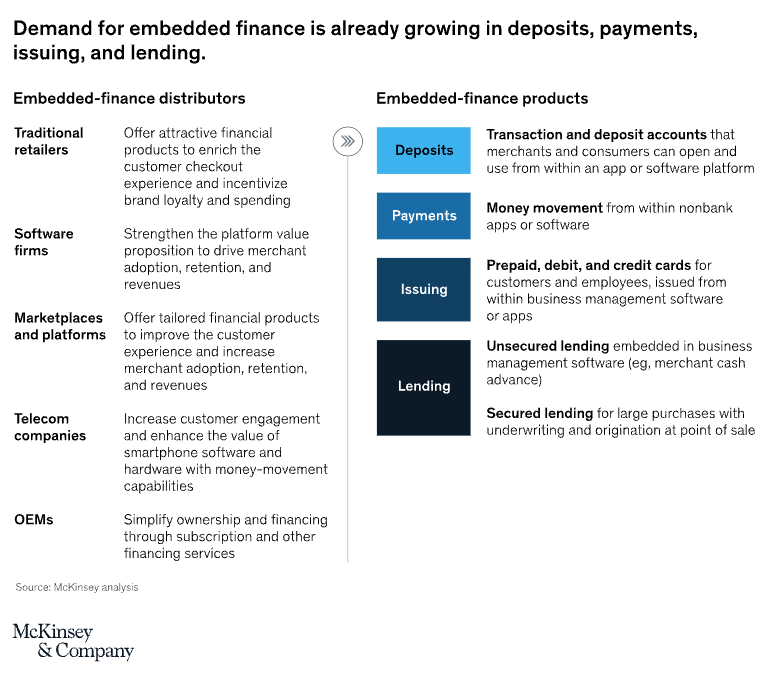

Who makes money from embedded finance?

Primarily, it’s the digital businesses – those who own the end-customer relationship. In other words, embedders like you, who might have a consumer-merchant marketplace like Shopify or a B2B SaaS platform like Ben.

Of course, embedded finance also involves a chain of companies working together (technology providers and financial institutions). And yes, embedded finance providers like Weavr do make money from embedded finance too, otherwise we wouldn’t be in business.

However, it’s embedders like you, who embed finance into an existing non-financial platform, who stand to make the most new revenue. That’s exactly what McKinsey saw in 2021: at least as far as payments and deposit products were concerned, businesses that owned the end-customer relationship benefited most.

That’s from transaction revenue alone – just one of the many ways you can make money from embedded finance.

While transaction revenue is significant, it’s not the first and primary source of revenue uplift. The real value is in having a platform that allows for a new type of UX wherever money enters the equation – where transactions, payment permissions and reconciliation become so frictionless that your end-users never think about the cogs turning in the background.

If that seamlessness is part of the value proposition of your product, you won’t just stand to gain from transaction revenue – you’ll also be making money from the new level of stickiness that embedded finance brings to your platform. Put simply, if you choose to embed finance, you can take your slice of that $4 billion, and more.

How does embedded finance make money for embedders and platforms?

Embedded finance has the power to bring uplift to almost every way your platform already makes money, from your billable seats to your pricing to your stickiness. It lowers customer acquisition cost (CAC), increases customer engagement (and spend), and extends customer lifetime value (LTV) – oh, and it can also bring you money from transactions.

1. How embedded finance can help with growth

More traffic and better funnel conversion rates

By adopting embedded finance, your platform can see a lower customer acquisition cost. And as you almost certainly know, customer acquisition cost (CAC) is a fundamental metric that impacts your revenue and profitability.

In short, platforms that embed finance have a greater chance of impressing prospective users and customers. This results in leads and higher conversions, and ultimately means a lower CAC.

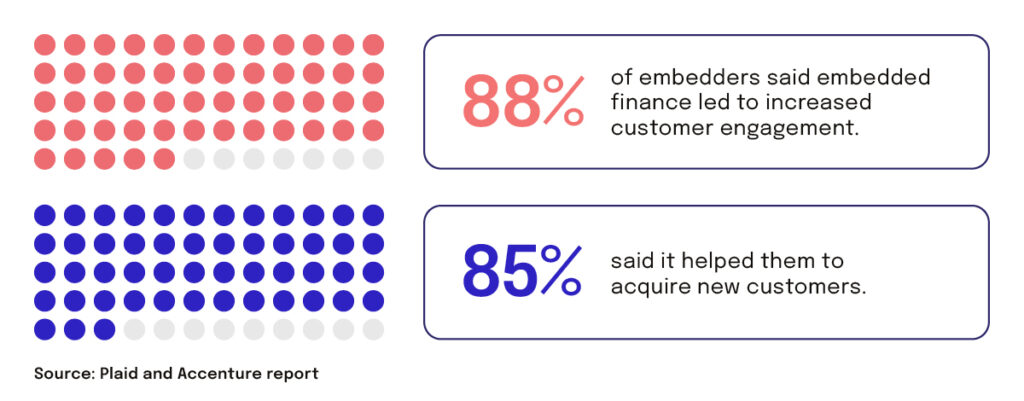

You don’t just have to take our word for it. A report by Plaid and Accenture found that 88% of embedders said embedded finance led to increased customer engagement, and 85% said it helped them to acquire new customers.

How does it do this? Well, have a look around at the competitors in your space and see who has already made a move into embedding financial features. What you’ll notice is that it’s usually quite obvious which of your competitors don’t have financial features and which ones do – because they’ll be boasting about it above the fold on their homepage and across all their marketing campaigns.

Why are platforms making so much noise about their embedded financial features? Because they enable an experience your customers can’t find elsewhere. It’s a differentiating value-add, or even a USP, as a marketer might say.

For instance, embedded finance can help a cloud accounting app to move cash, not just watch it. Users of these apps are familiar with the standard set-up that allows them to track invoice payments and match up data for reconciliation. But, with embedded finance, the app can now detect payments, adjust statuses automatically and, importantly, make payments.

By offering a more complete digitally-enabled experience like this, you’ll stand above your competitors and both your volume of signups and signup-to-sale conversion rate will increase.

More billable seats

By embedding financial features in your platform, you can draw in greater numbers of paying users – the “billable seats population” – than was possible before.

A company might already be using your software, but only within one department, or with a fraction of their employee base. Embedded finance can quickly enable your platform to spread throughout the rest of the organisation.

Let’s say you have a corporate-procurement platform, and you start offering brandable cards that employees can use to pay for services and resources, and they can quickly get what they need without waiting for the traditional slow B2B payment process to kick in. That’s not going to be an offering that stays in one department for long. Everybody prefers to make easier and safer purchases, provided the financial controllers are happy too (and with the right solution they will remain in full control).

To take it further… at the moment, your platform’s primary users might be financial teams, or specific business operations like IT management, marketing, or supply-chain procurement. However, by solving payments and payment controls within your software, you can offer far more effective interdepartmental collaboration. Whether it’s a use case that lets finance teams loop in non-financial colleagues, or vice versa, your product has now added a growth engine that spreads adoption across more and more new paying users – and your platform can become the tool of choice for BAU operations.

2. How embedded finance can help with the monetisation of your platform

Higher conversions between subscription tiers combined with justification for charging more for higher tiers

Adding financial features into your application won’t only boost signups, it can be transformative to your whole pricing strategy. All you need to do is lock certain elements behind mid and higher pricing tiers.

If you’re a leader in a product business, you’ll be familiar with the challenge of how to design pricing that offers a low-friction entry point (perhaps even a free tier) versus rising steps through mid and premium pricing tiers. Those higher tiers need to capture revenue in a way that keeps in step with your customer’s perception of what is worth their time and money.

If you lock them behind mid and higher pricing tiers, it helps you demonstrate a very obvious step-change in functionality and perceived value.

While use cases within different EmFi business models might differ on adoption and maturity, the opportunities associated with the use of EmFi are vast, making the widespread embedding of financial services into all sectors almost inevitable in the future.

KPMG paper ‘Harnessing the power of embedded finance There’s a revolution coming‘

Let’s say you have a remote working platform that gives remote employees an easy way to get approval for expenses for things they need e.g. co-working space, networking budget, L&D opportunities, etc. Well, with embedded finance, that platform could give employees an easy way to not only get approval but actually pay – with their employer’s money – for certain types of purchases that fall into carefully pre-approved categories.

Imagine if your mid pricing tier offered those employees virtual cards and accounts, and your premium tier offered the possibility to send out physical cards with their employer’s branding. With embedded finance, any agile digital innovator can include that kind of functionality within their platform – and increase their subscription revenue as a result.

3. How embedded finance can help increase customer loyalty

Longer customer lifecycles and subscriber commitments, and lower churn rates

One of the most significant ways embedded finance can make embedders and platforms money is through stickiness and increasing customer lifetime value. Or depending on how you want to look at it, making a huge cut to your churn rates.

Every platform wants its customers to stick around for life, but achieving that is a tall order in a competitive market. Embedded finance brings that dream within reach.

Quite frankly, this reason alone could be enough for you to go back to your desk and prioritise a look into embedded finance use cases.

Do your business users depend on your product? Is it essential? Few products can say this, but every product manager is trying to move the needle in that direction. The monthly active users (MAUs) and engagement statistics on your dashboards are all indicative of whether a customer is likely to stick around or consider switching to a competitor.

Embedded financial features move a customer towards the ‘more likely to stick around’ end of the scale.

Partly that’s because payments and cards are positively sticky in themselves. Let’s imagine an SMB customer using your platform. They have all of their employees set up with expenses or benefits debit cards, issued via your app and fully integrated into your UX, and those cards could be branded with the employer’s logo. How easily would your SMB customer switch all that off? They wouldn’t consider it lightly.

But the main reason this customer would stick around is that embedded finance offers a radically more convenient, controllable, and cost-efficient alternative to clunky traditional processes. And once such a financial process is in place and working well, businesses don’t want to change it casually.

In other words, your platform finally becomes irreplaceable. Or at least as close to irreplaceable as it’s possible to be.

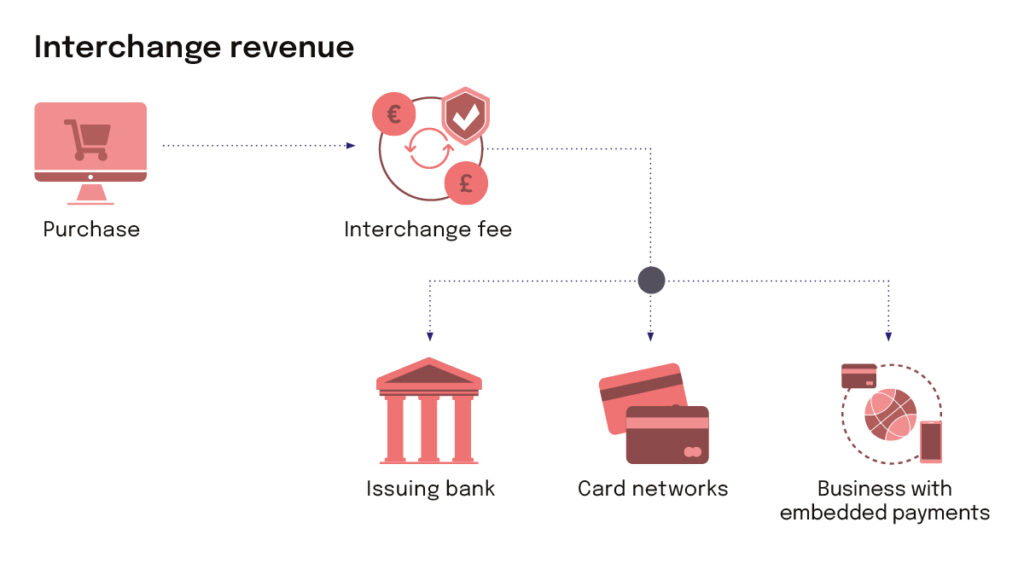

4. How embedded finance can unlock transactional revenue

If your main aim is to get more revenue out of your current user base, you don’t need to offer your users features as part of your base offering, you could charge extra for them. As we saw earlier in our analysis of the market, for platforms like yours, there’s $4 billion in embedded transaction revenue alone up for grabs.

Interchange revenue is the small percentage of each card transaction that’s paid to those providing the financial infrastructure that makes payments possible, usually VISA or Mastercard. In essence, it’s the small percentage charged to every merchant per transaction – and it’s why corner shops enforce a minimum spend and don’t want anyone paying for a single Freddo chocolate snack by card.

Now, making interchange fees part of your monetisation strategy might not be obvious if you’re not already in the payments sector, but it’s a key source of revenue for many fintechs and challenger banks. And it can be yours too.

You can also charge in ways that go beyond traditional interchange revenue. For instance, if you have a procurement platform, you could charge users every time they choose to let your app automate reconciliation for them. It’s time saved for them, and it’s cash in the pocket for you.

If you want more in-depth knowledge on how interchange revenue would work for your business, chat to a Weavr expert today.

5. How embedded finance can help breakout strategies become possible

Adding embedded finance as an ingredient to your platform provides a repeatable and reliable way for your brand to break out into new markets. That’s because, with embedded finance, your core customer base has become more stable, your differentiators are more persuasive, and your customer profile has become more profitable.

A new go-to-market strategy (GTM) no longer needs to imply the dreaded development of a different product. You’ve got a proven formula, and there’s far less risk involved in breaking into a new market.

Many SaaS products get caught in a vicious cycle. Economic and competitive pressure often weaken a platform’s appetite for R&D investment at exactly the wrong time: at the moment they need to make major bets to break out, outclass competitors, and gain market share in new addressable spaces.

And often, that reticence is well founded: a new GTM takes big chunks of investment in marketing and operations as well as R&D to make adaptations to the product. That’s true whether you’re targeting an adjacent vertical (or customer profile) or trying to copy-paste your business model into a new geography.

Many of Weavr’s customers now operate in multiple geographies.

For example, one customer already had an established strategy, and product featuring embedded finance, tailored towards their French market. So when looking to expand to the UK, the repeatable formula and strong foundations had already been laid – making it much easier to expand their SaaS product.

When embedded finance is in the mix, the business will be in a stronger position, and they’ll find existing potential “breakouts” are addressable at lower risk.

How embedded finance makes you money, a visual summary

Before you head down to the detailed example of Procurement Pangolin to see what’s really possible for SaaS products like yours, let’s sum up with we’ve seen as the highlights so far…

How much revenue could embedded finance make a platform?

Adopting embedded finance produces an uplift effect across all of the revenue and growth KPIs you already watch – plus any new revenue you choose to skim off the top of any transactions customers make in your platform.

Why don’t we see if we can write some back-of-an-envelope top-line numbers into this?

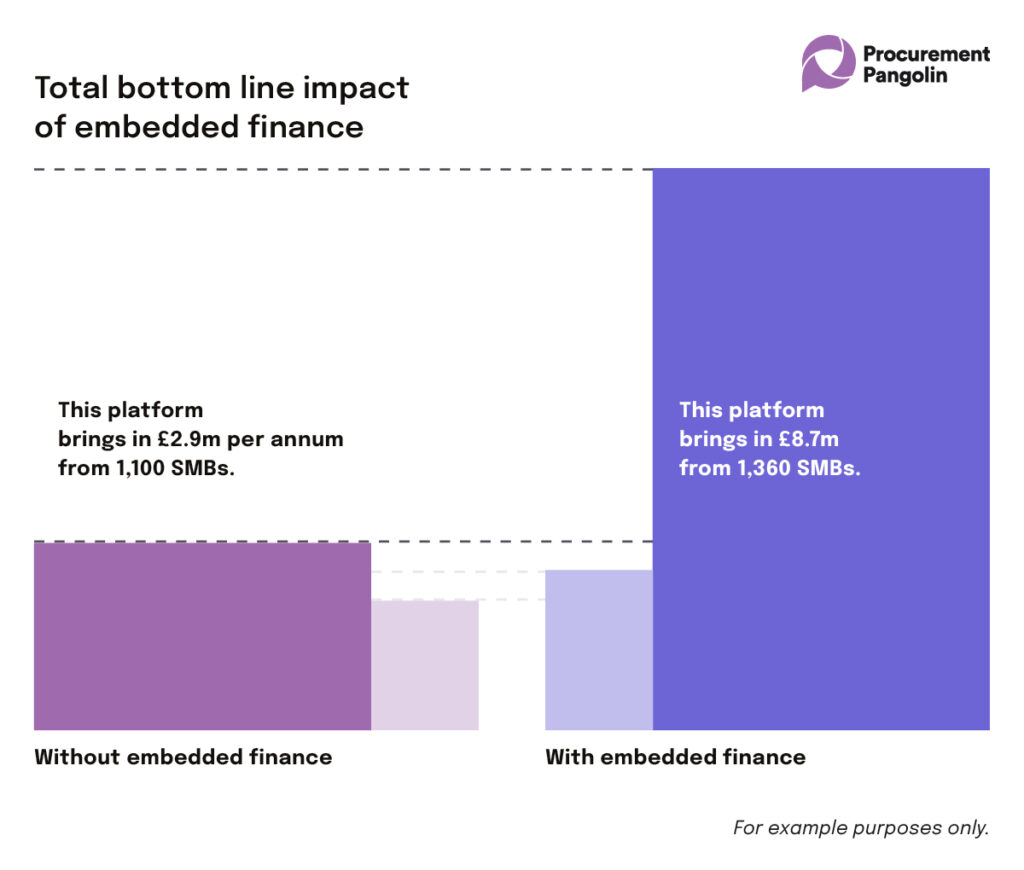

Let’s profile an imaginary, established B2B procure-to-pay application – we’ll call them Procurement Pangolin. The platform brings in £2.9m per annum from 1,100 SMB customers.

At the start of the year they’d gone live with a new embedded finance programme.

What might that year look like with embedded finance, compared to what it would look like without it?

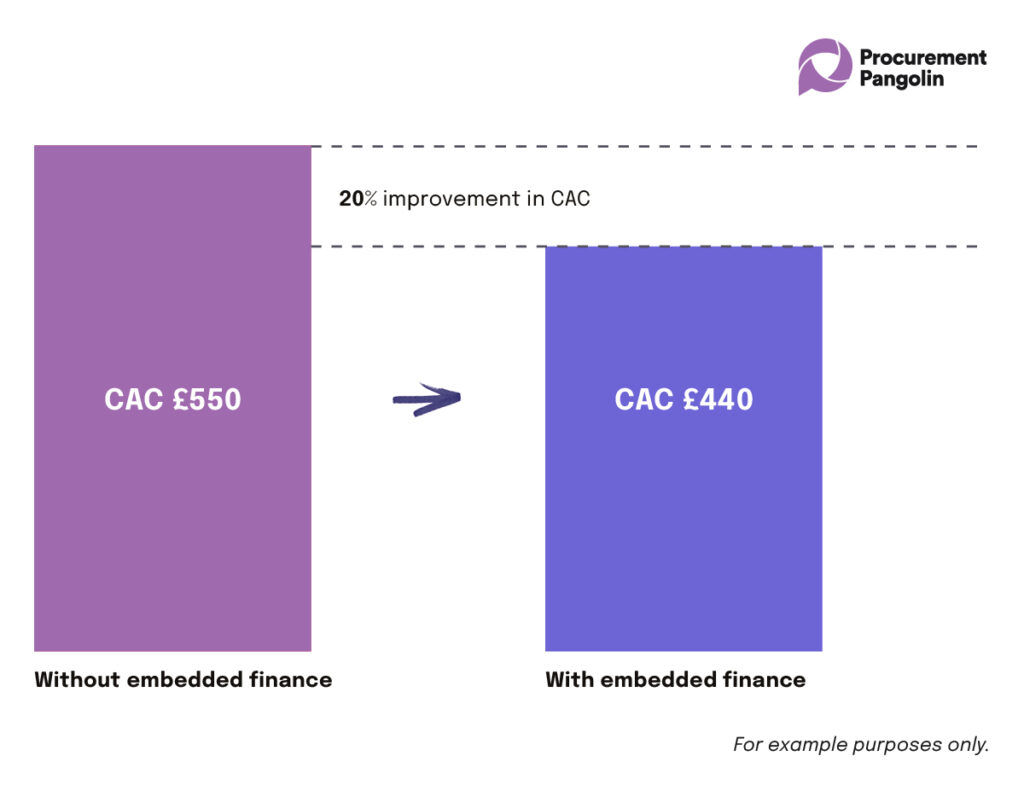

1. Customer acquisition cost

Thanks to embedded finance, Procurement Pangolin has differentiating new features on display. The application proves more attractive in marketing performance and converts more new SMB sign-ups, lowering the average cost of acquisition.

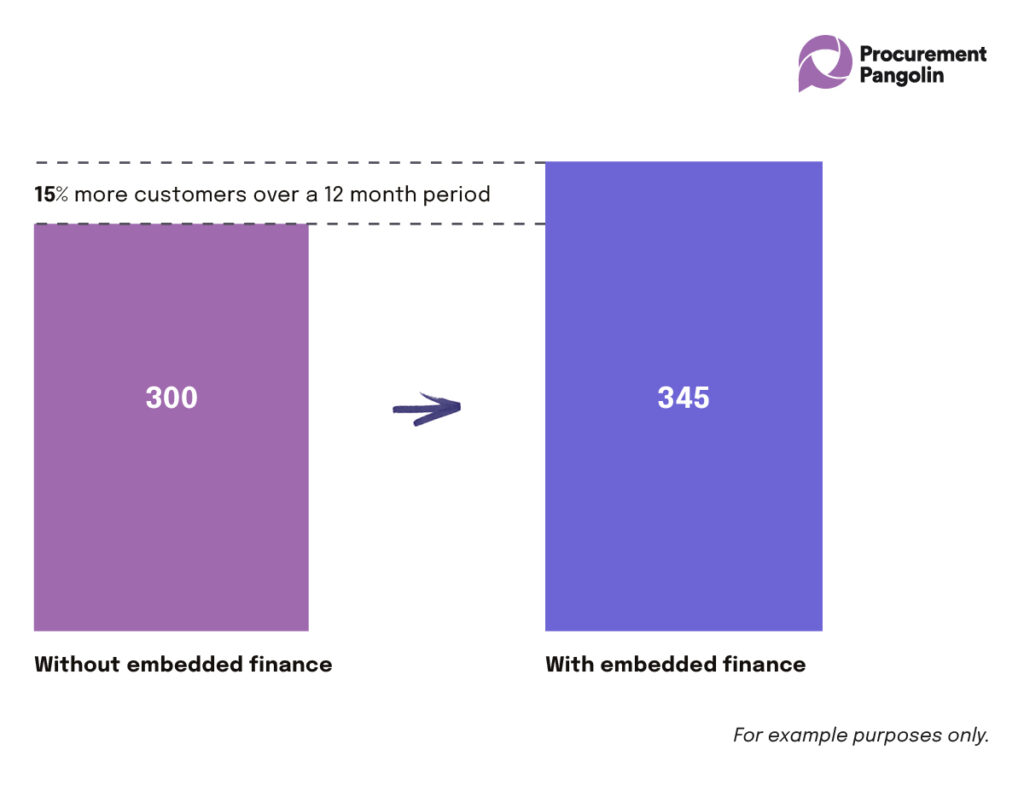

2. Customer acquisitions

With a better conversion rate and lower customer acquisition costs, Procurement Pangolin can target growth marketing more confidently and win significantly more customers without having to seek additional advertising budget.

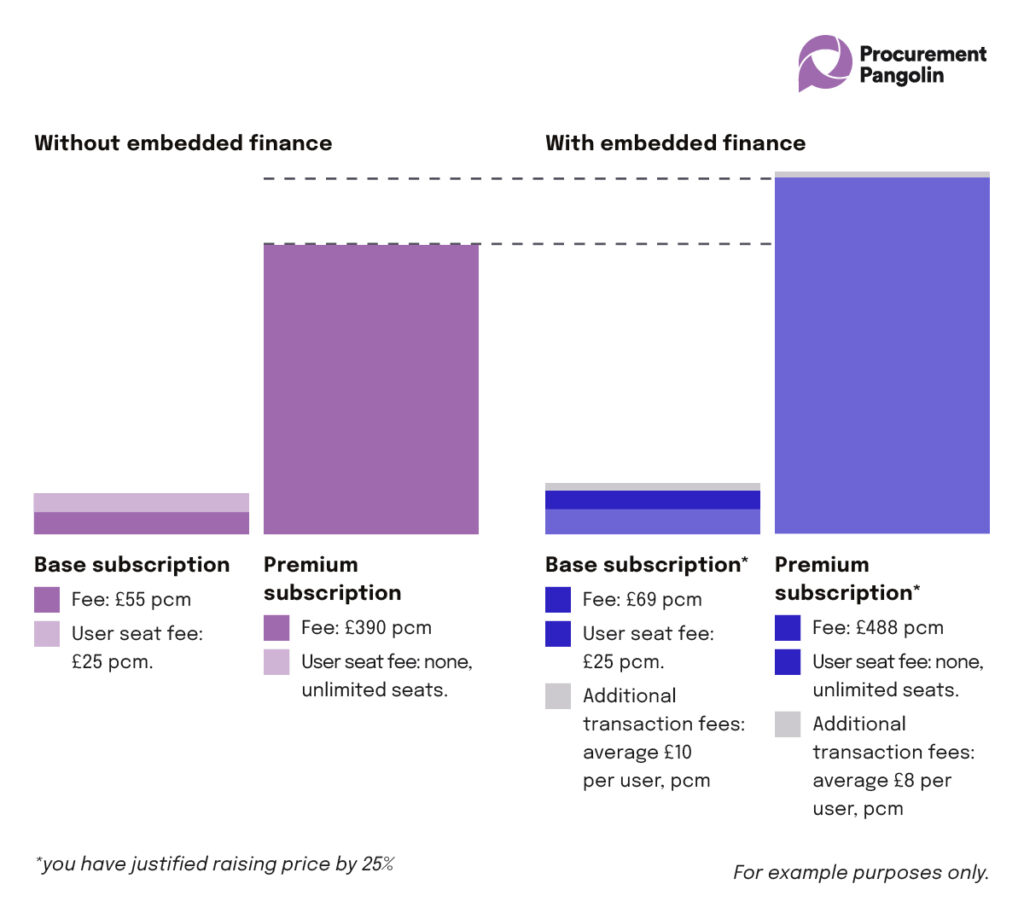

3. Pricing and fees

With all these new shiny tools and a vastly improved customer experience Procurement Pangolin feel fully justified to raise prices – as demonstrated in the example below.

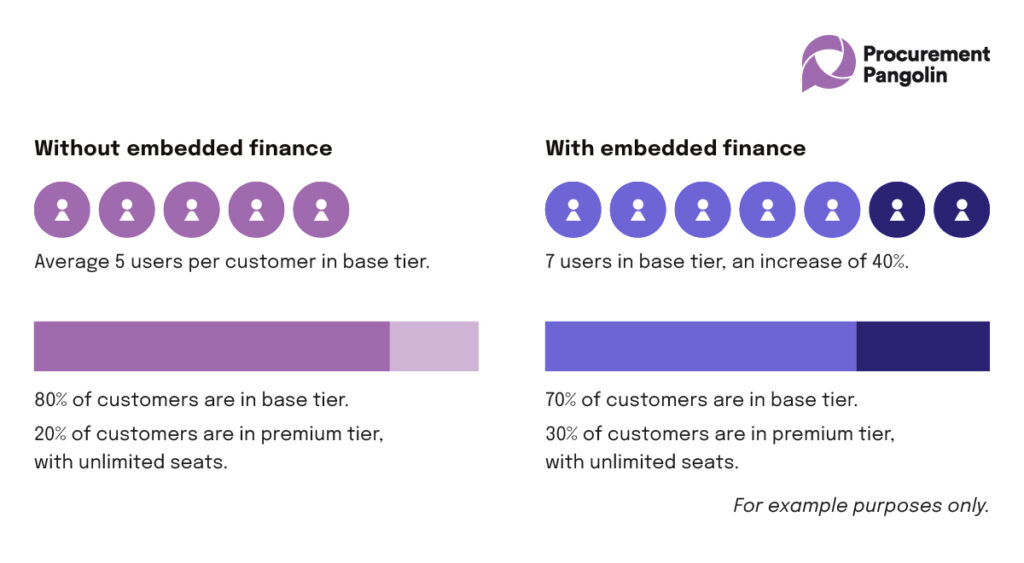

4. Billable seats population

By embedding financial features, Procurement Pangolin can draw in greater numbers of paying users – the “billable seats population” – than was possible before.

5. Stickiness

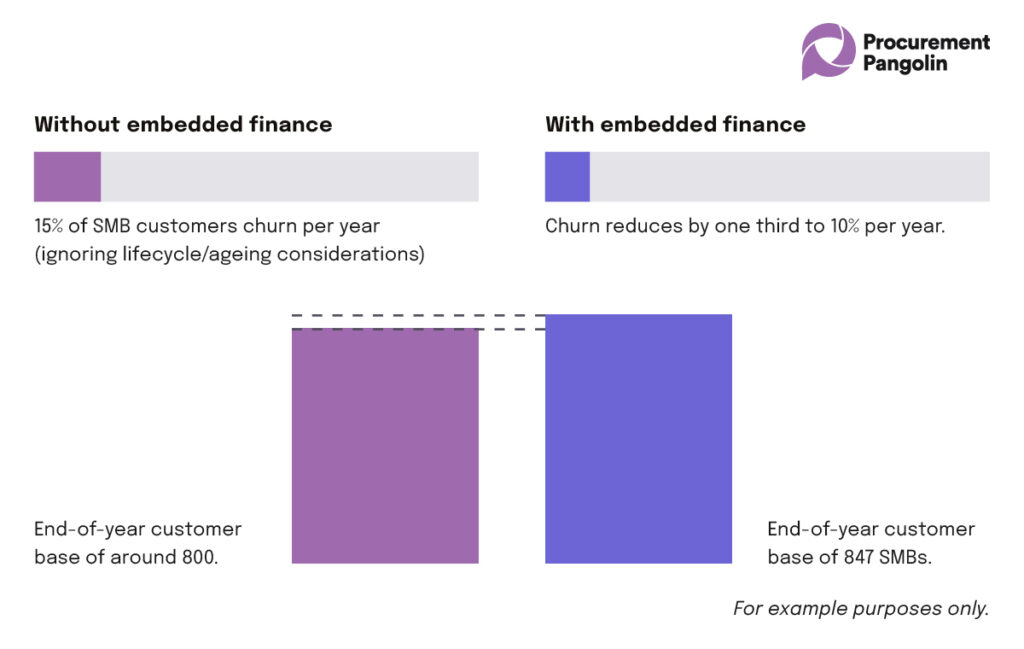

Embedded finance provides a convenient, controllable, and cost-efficient alternative to traditional processes. Once in place, businesses with Procurement Pangolin won’t want to change. Churn reduces by one third in the first year.

6. Breakout strategies

Without embedded finance: Let’s assume this product has no “breakout strategy” on the cards.

With embedded finance: The new, stronger, competitive posture of the company enables it to tackle a go to market: same proposition, different country. What works on home turf turns out to be just as attractive in a next-door market. As it’s just the first year, we’ll say Procurement Pangolin won 170 customers of a similar profile.

Yes, that’s what it looks like: embedded finance multiplying revenue by two. This is what the headlines commonly say about the embedded finance opportunity. It sometimes sounds like hype, but in the estimates we made in the example above, you’ll see we were actually conservative.

Conclusion

We can’t tell you the answer for your business, but you can. Take our ideas above and put them in a new spreadsheet or your actual financial models. Then ask yourself what other just product strategies on your roadmap can come close to these multi-lever effects. You might find that adding embedded finance is like adding octane to your growth fuel.

If you’d like help generating and validating a proof of concept, don’t hesitate to talk to an expert or check out our embedded finance buyer’s guide.