- Introduction

- What is embedded finance?

- What are the benefits of embedded finance?

- What are the different types of embedded finance?

- Who is embedded finance for?

- Why is embedded finance important?

- How does embedded finance work?

- What are examples of embedded finance?

- How is embedded finance revolutionising financial services?

- The next chapters of the story

In this guide, we’ll explore what embedded finance is and the benefits it brings to digital platforms and the people who use them. We’ll also cover who can take advantage of embedded finance, and how ambitious innovators and embedders are already integrating financial services into their apps.

In today’s digital-first world, efficiency and a seamless user experience aren’t just perks that customers look for – they’re a core expectation. The user’s journey through an app is one of its key differentiators and can make or break a product’s attempt to win market share. But while digital innovators generally excel at UX design and intuitive user journeys, those efforts find a whole new world of opportunity when finance enters the equation.

That’s where embedded finance comes into play. Whether it’s shaving off the friction from supplier payment chains, giving freelancer workers more control over their income streams or axing the financial admin involved in employee benefits and expenses, embedded finance gives digital innovators a way to integrate essential financial capabilities into their platforms as seamlessly as any other functionality.

Let’s get those questions answered!

What is embedded finance?

In the simplest sense, embedded finance is the outcome of bringing financial products into non-financial customer experiences – in other words, embedding them.

For it to be true embedded finance, the integration must be seamless, with the financial product under the roof of the non-financial brand (e.g. Uber, Shopify) rather than that of a separate financial services brand (e.g. Stripe, Revolut, Lloyds Bank).

For instance, embedded finance could look like an invoice-tracking system that now also enables payments to suppliers, provides notifications to confirm successful completion of those payments, and also handles reconciliation. For the removal of doubt, those financial features are an integral component of the invoice-tracking system’s application – not a side activity. Now the invoice-tracking application doesn’t just track invoices. It also has payment capabilities, automations and extra add-ons that you get when you embed finance.

The embedded finance industry is young and so exact definitions are hard to come by. That’s partly because the actual mechanics of the system, and the parties involved, can vary greatly. Essentially though, it’s the outcome rather than the system behind it that defines embedded finance. That outcome is financial capabilities in a non-financial customer journey, either where the customer needs to access them or where they’d form a natural enhancement of their experience.

You may have heard of household-name brands getting involved with embedded finance. Starbucks, for instance, uses embedded finance to supercharge its rewards and loyalty scheme. Their Starbucks Card mobile app operates as a mobile payment platform, allowing customers to load their digital loyalty card with money and pay for their venti cappuccino and blueberry muffin directly from their phone. That gives customers a slicker purchasing experience, but also gives Starbucks more insight into customer behaviours and choices, meaning they can drive personalised rewards to each user and boost engagement with the service.

That’s not to say embedded finance only becomes an option when your resources are as large as a multinational coffee company. When embedders partner with an embedded finance supplier, it lowers the bar to entry by removing the need for your developers to become experts in complex financial infrastructure or to find resources for a compliance team (more on that below). And when that barrier comes down, it opens the door to features that would otherwise be out of reach for all but the biggest players. To borrow a well-used term, it “democratises” access to the data and financial services for more kinds and sizes of business.

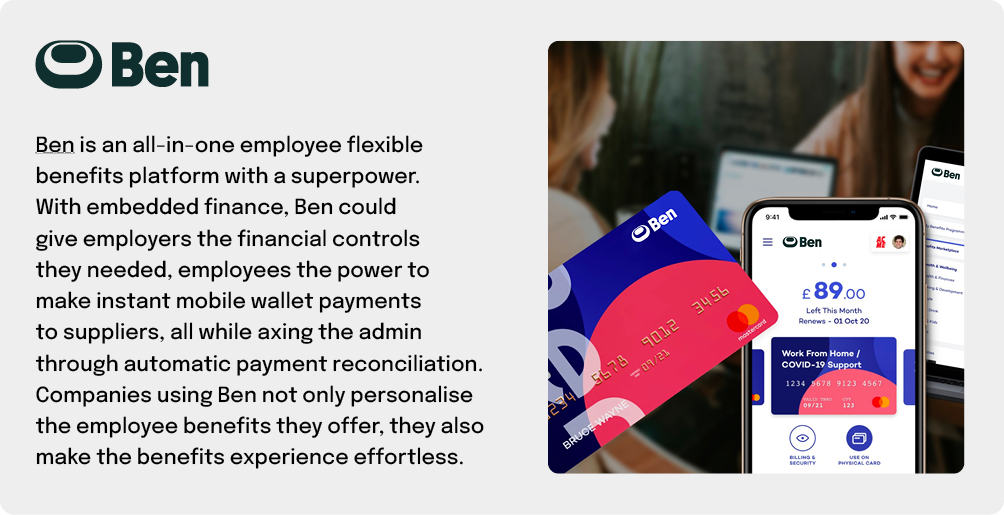

Weavr’s embedded-finance platform, for instance, is currently powering solutions like Ben, a flexible benefits platform that allows businesses to issue branded benefits cards to employees, set controls and budgets to manage provision, and automatically reconcile payments. Ben isn’t a financial company and so they needed a partner that could bring the financial firepower in the form of payment cards, handy automations and handling highly specialised and important processes like compliance.

Whether it’s to enable employees to redeem their flexible benefits or coffee drinkers to access their loyalty rewards – or any number of the other use cases Weavr currently powers – embedded finance allows end users to access financial products without being redirected out to third-party apps. The result is a seamless experience from start to finish – but more on that below.

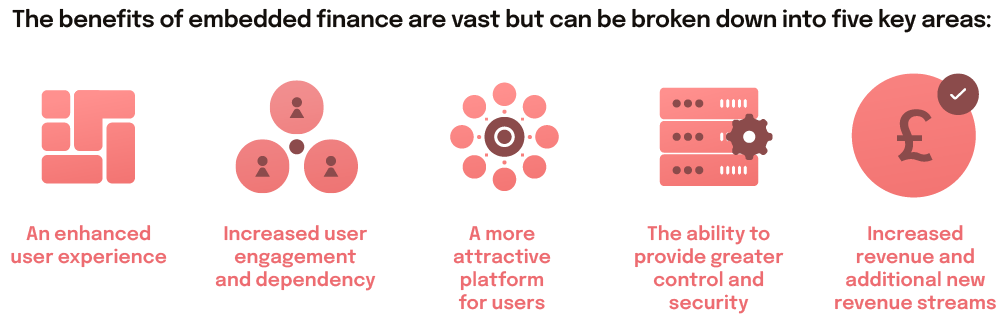

What are the benefits of embedded finance?

The benefits of embedded finance are vast but can be broken down into five key areas:

- An enhanced user experience

- Increased user engagement and dependency

- A more attractive platform for users

- The ability to provide greater control and security

- Increased revenue and additional new revenue streams

1. An enhanced user experience

For instance, if employees use an expenses platform that has embedded finance, new controls over who can spend what, where and with cards loaded with the company’s money mean that the experience changes entirely. Expenditure is planned, controlled, expected, and employees aren’t out of pocket. Compare that to the typical model where employees make a purchase and then have to claim back benefits with receipts. For back-office teams, it means they don’t have to spend their day filing admin to reimburse employees, or be on the receiving end of complaints from employees who are still waiting for their payments.

Embedded finance also allows for greater automation where reconciliation is concerned, meaning back office teams can leave the platform to handle repetitive tasks that would normally be done manually.

2. Increased user engagement and stickiness

When embedded finance allows users to move money around within a digital ecosystem, it creates a slick experience every time they need to make a payment. The slicker the experience, the stickier the platform will be for users – and the greater the competitive advantage for embedders.

Take Ben’s flexible employee benefits platform, for example. With the ability to issue branded benefits cards, Ben makes it possible for employees to pay for their perks directly from a benefits budget. There’s no need for them to mess around with redeeming coupon codes that don’t always work, or pay for benefits with their own money and submit receipts to claim it back. It’s as smooth and seamless as paying for a morning coffee.

3. A more attractive platform for users

Embedded finance doesn’t just help embedders streamline what they already offer. It also opens the door to offering entirely new services that just weren’t possible before – drawing in users who might otherwise have dismissed the platform.

A richer user experience is always attractive, and can give your business that competitive edge. A piece by Plaid and Accenture shared that 85% of companies that implement embedded finance report that it’s helped them acquire new customers.

From issuing accounts and cards to customers (physical and virtual), to controlling payments within your ecosystem, to generating more revenue from existing customers – all is possible via straightforward API access.

4. The ability to provide greater control and security

Although embedded finance empowers individual users to make payments instantly and directly from within the everyday applications they use – removing the need for back office teams to reimburse purchases or be the sole executors of payments, for example – it’s not at the expense of security.

Stringent controls are woven into the fabric of embedded finance. When a company issues a virtual or plastic card to an employee for their expenses, for example, they can also lock that card to specific merchants, set caps and usage limits, and see exactly what the card has been used for rather than just a figure on an expenses claim.

Think about it – controls over where money can be spent, by whom, in which currency and so on are defined up front before a payment is made. It’s the complete reversal of the traditional post-purchase experience whereby an employee, for example, will buy something for work on their own card and then hope the purchase is approved when they file an expense. There’s less risk for the financial controller (as they set the rules!) and less risk for the employee of their expense being rejected. And they don’t have to use their own funds. It’s a win-win.

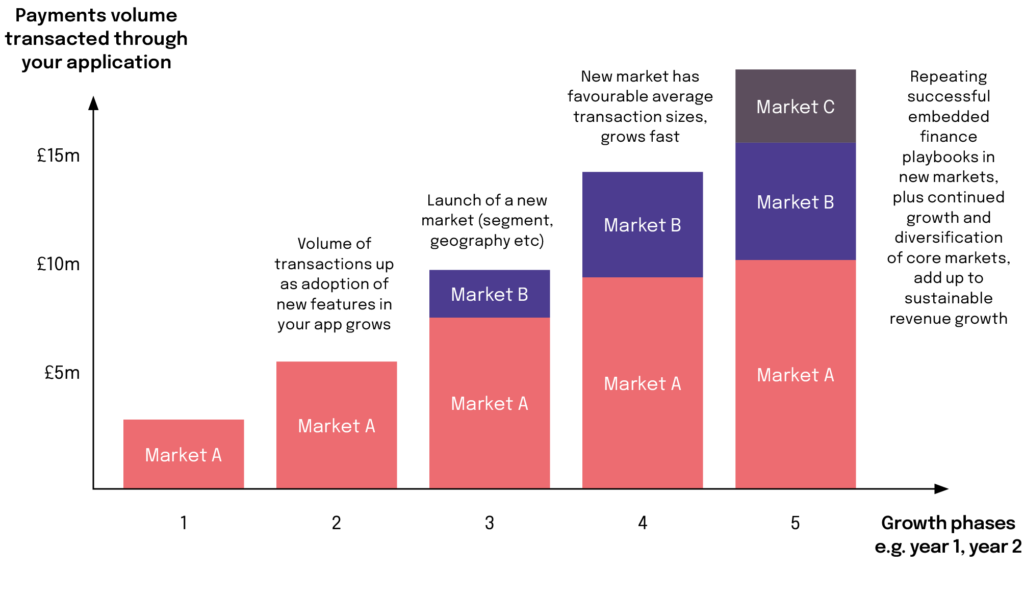

5. Increased revenue and new revenue streams

Rather than being a cost centre, embedders can look at embedded finance as a new way of driving growth and revenue for their platform. Part of that is down to increased users and engagement, but embedded finance also allows embedders to multiply revenue per user and unlocks new revenue streams.

- Monetise SaaS seats more effectively

Let’s say you already charge for your platform’s services. Well, embedded finance can enable you to step away from one-size-fits-all payments and simply make the process smarter and more appealing.

With more granular control, you can offer more personalised discounts, incentives and bundles, and use those as an inventive way to increase usage and generate revenue.

- Earn fees on payment flows through your app

Embedders can monetise the financial services they offer via their platform – for example, they can add a fee to process payments or issue cards – and use embedded finance as a means of growing revenue without increasing marketing spend.

Not forgetting the ability to scale, it’s important to for embedders to consider the lifecycle of their chosen embedded finance solution. (This is covered in more detail in our handy “Embedded finance – a buyer’s guide“, in case you want more detail of those later down the road considerations.)

- Build a roadmap of premium financial features

Embedders might choose to keep some financial features behind a premium tier. For example, if we stick with the example of an employee benefits platform, the obvious application for embedded finance would be using it to make redeeming and claiming perks easier. But an embedder could also add premium offerings, such as access to loans for employees, or company-branded cards.

What’s more, those features can be offered in the context of the user. With greater insight over how users are spending or moving money within your ecosystem, you can better understand what financial services they need and will use.

What are the different types of embedded finance?

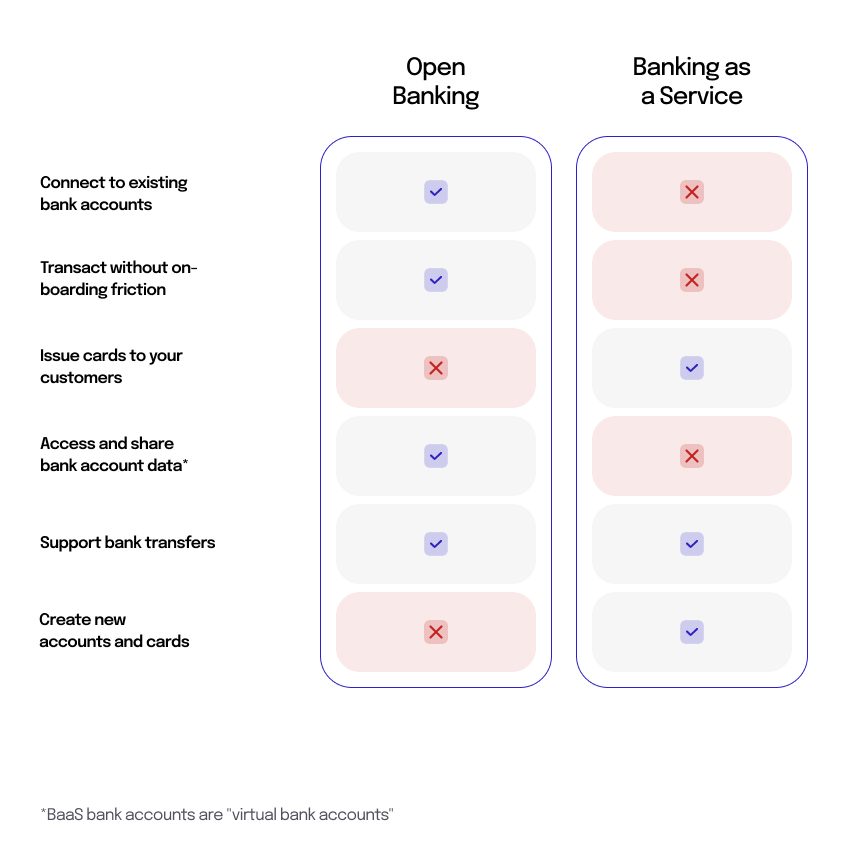

If you’ve begun looking into embedded finance, you’ve probably heard of three different terms by now: open banking, Banking as a Service (or BaaS for short), and embedded finance itself.

If those terms sound confusing or even interchangeable, we don’t blame you. While each of the three are highly distinct when it comes to their functionality and what’s expected of embedders to run the system, it’s easy to assume they’re more or less the same at first glance.

Open banking

As the name suggests, open banking is about opening up access to bank accounts. It’s a framework that allows end users to share their financial data with third parties, giving embedders more data to analyse when they design new features.

Open banking has already found use cases in plenty of financial contexts. For example, in wealth-management apps that analyse spending and offer advice and investment ideas, or with bank-transfer payments to pay off your AMEX bill. However, open banking is really limited to a) reading data in bank accounts that already exist – it can’t create new accounts, and b) making bank-transfer payments.

Open banking certainly doesn’t hold all the answers for the unification of digital and finance. It also has its detractors, one such detractor is Anne Boden CEO of Starling Bank who branded open banking as a flop that’s too costly, “clunky” and said businesses struggle to make money from it.

Weavr Co-Founder and CEO, Alex Mifsud argues that Boden’s comments were premature.

“Open banking is a foundational idea which will take longer to have an impact than its original boosters have predicted but will in time be far more disruptive than many expected,” Mifsud told Verdict. If you’d like a deeper look into the differences between open banking and BaaS, you might enjoy this article on our Knowledge Centre from which we’ve pulled out this quick comparison framer:

Banking as a Service

While open banking can’t create new accounts, Banking as a Service completes that side of the picture. It gives embedders the power to create accounts and issue new cards to customers. But BaaS providers often only provide the raw APIs for that functionality, leaving the embedder to shoulder the regulatory and compliance burden themselves – making it viable for fintechs but not for everyone else.

Why is that? Financial services is a highly regulated industry and for good reason. Compliance, regulation and data security exist to ensure that customers – both businesses and end consumers – are protected. If a non-financial business wishes to offer a financial service, by partnering with a BaaS supplier for example, considering how compliance will be handled is of paramount importance. Fintechs typically have appetite to take on the task as they are financial technology companies after all. However, a freelancer marketplace or expense-management platform do not and are not. In the vast majority of cases, they’ll need more than a pure BaaS supplier as the regulatory aspects are too much of a hill to climb for them.

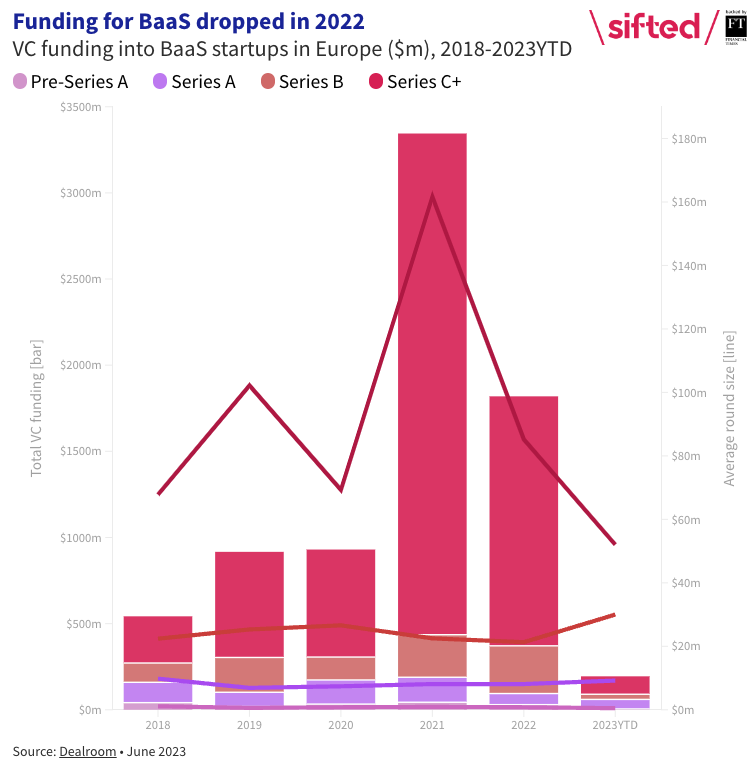

Just how popular are BaaS providers with fintechs? 82% of Europe’s fintechs partner with a BaaS provider and the latter enable an average 45% of their overall revenues, according to research by Datos Insights.

According to Sifted: “for every one European BaaS provider, there are thousands of fintechs — and the same research suggests they’re [BaaS providers] struggling to keep up.”

However, as captured in the above quote, the relationship between fintechs and their BaaS suppliers is evolving. Datos Insights’ research found that one in five fintechs are losing $11m a year in product delays due to their BaaS provider; 40% of fintechs have experienced service outages; 33% have lost customers as a result; and 20% have faced regulatory interventions due to issues with their provider.

Far from plain sailing, the BaaS industry is facing a challenging funding and regulatory environment. At the time of writing, there are doubts over the continued viability of the current BaaS model.

BaaS 2.0

Embedded finance is often called BaaS 2.0 because it provides the same capabilities as BaaS – the ability to plug financial services into a platform – while solving the problems BaaS providers usually leave on their customers’ plates (dealing with compliance). As well as the APIs, businesses that embed finance with BaaS 2.0 providers typically get onboarding tools, Know Your Customer (KYC) and Anti-Money Laundering (AML) built in, as well as the support of a compliance team without building your own.

BaaS 2.0 can also cover a variety of applications. With Weavr’s mission to bring down the barriers between embedders and financial services, we’ve adopted a plug-and-play approach that wraps up typical configurations for use cases within employee-directed applications, supplier payments and freelancer-worker platforms. At the same time, we also build bespoke solutions – because as embedders continue to innovate, not every use case will have a pre-configured plug in ready to go. In short, non-financial companies can now safely add financial features to their applications with a BaaS 2.0 (or “embedded finance”) provider as they will have full support on handling the thornier aspects of offering financial services.

Who is embedded finance for?

- End customers

Embedded finance is for end users, since it enables a task they need to be done to become a seamless and smart experience, e.g. a person ordering a taxi, a businesses getting paid for its services, or an HR leader managing employee expenses, etc. Embedded finance ultimately makes it possible for businesses to solve more customer problems than ever before, whether that customer is a consumer or a multinational company.

Of course, this isn’t to say the end customer is the one buying embedded finance. They might even be unaware of its existence, despite benefiting from platforms that make use of it.

- The businesses implementing it (embedders)

Embedded finance is for any digital business that wants to bring financial products into a primarily non-financial platform.

If you want to get more specific, an embedder is someone who makes a non-financial digital product like a SaaS platform and needs a depth and breadth of financial capabilities, but can’t (or won’t) build it themselves.

If you’re one of those digital businesses, it’s unlikely that you’ll have the kind of resources to take a raw BaaS API and run with it. You also are unlikely to want to deal with the biggest headache of all for non-financial embedders – compliance. Sound like you? Great, you’re still in the right place.

BaaS 2.0 solutions, such as Weavr’s Plug-and-Play Finance solution, have been specifically developed to bring down the barriers between digital innovators and embedded finance. As a predefined full-stack solution, our solution gives embedders access to a suite of financial services, product logic and processes tailored to their business context, and with reduced heavy-lifting required from their development team.

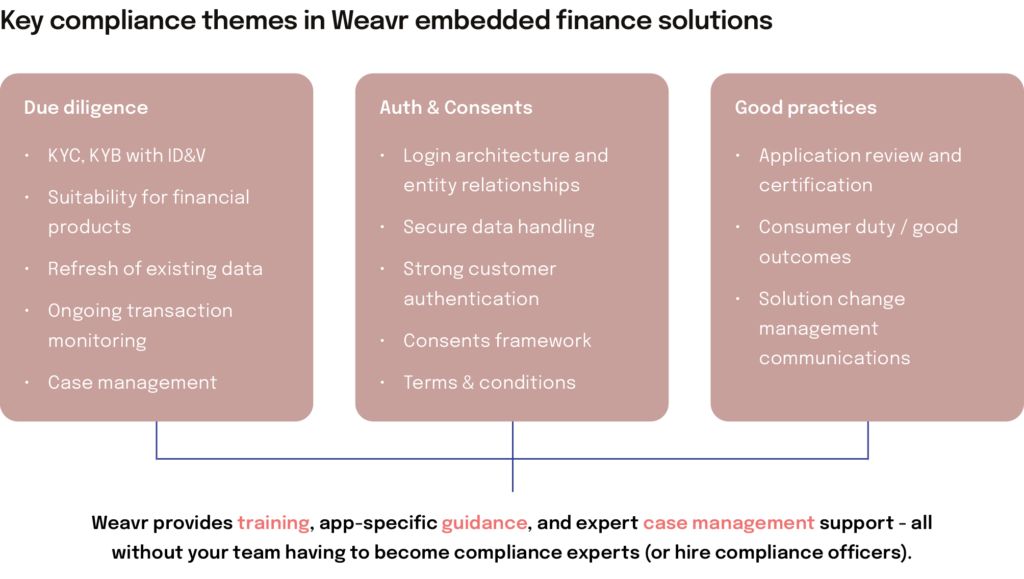

As well as providing financial licences, BaaS 2.0 providers like Weavr also take care of all ongoing compliance for embedders. If any part of your product touches a financial service, you will have to be certain it complies with every regulation in the book – that means licences, transaction monitoring, protections against money laundering, even international sanctions list checks. The list goes on, and is constantly being updated. As indicated previously, is that something you want your resources to get bogged down with? Of course not – which is why Weavr handles the burden of compliance, ensuring embedders can stay on the right side of the regulator without needing to field an expensive compliance team themselves.

Why is embedded finance important?

1. Embedded finance offers new frontiers for innovation

Embedded finance is important because it’s changing the way financial services are made available to consumers, allowing embedders to deliver products like cards, accounts and loans to their users at the point of need. It’s obvious but people need finance to further their aspirations. Hence, making finance available to people in the context of routine activities, such insurance being part of a mobile phone purchase journey, only makes a lot a sense.

Embedded finance fundamentally changes the answer to the question: “how far can digital transformation go?” Up until recently, there were practical limits on digitalisation when it came to providing financial services in a non-financial context. Now those barriers have come down and there’s a world of business models that be improved or invented from scratch.

Let’s say you wanted to provide student loans from within a university-selection app. If you were a financial institution that offered loans, the use case might be too narrow to justify developing the app. On the flip side, if you were the developer of a university-selection app, it would be impossible to offer loans. You would be forced to refer users to a bank or government body – placing a hard boundary on the digital experience. Until now.

With embedded finance, you could be the university-selection app that offers students loans tailored to their specific needs, who they are and even with pre-approval as the data the university-selection app has enabled the lender to green-light the study already. Wouldn’t that be a game-changer?

2. Embedded finance is going to change how the world works

History shows how strong the lure of a seamless digital experience can be. Take ecommerce, for example. Checkouts appeared on websites and people could buy things with their credit card. Twenty years ago, consumers were still sceptical – they wanted to know how they could trust the quality of a product they couldn’t see or feel first. And adding your card details to a checkout seemed off-puttting. But today, ecommerce is simply how the world shops. Add to basket, tap to checkout, scan your face, and that book is on its way to you.

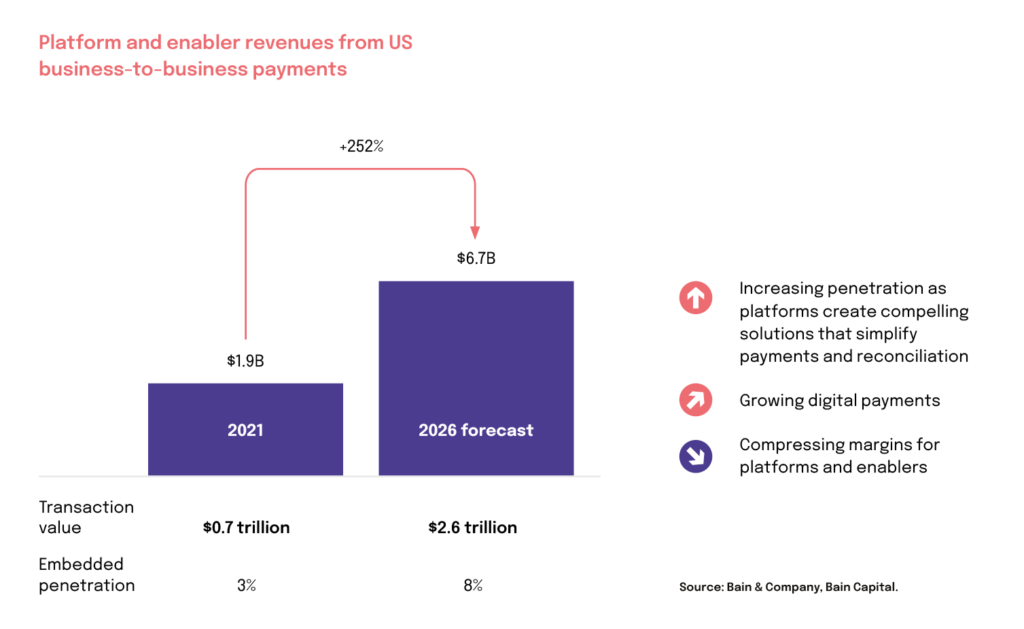

In many ways, embedded finance today is where ecommerce was then, and is set to rise just as rapidly. That’s not just a feeling, it’s backed up by the numbers. Research from Bain and Company found that embedded financial services accounted for 5% – or $2.6 trillion – of all US transactions in 2021, and that number will rise to 10% or $7 trillion by 2026.

Uber’s slick cab-payment functionality, Starbucks’ loyalty card, Ben’s employee-benefits platform and many others are category-defining experiences that we, the users, won’t want to step back from. Use cash for your next cab? No thanks.

When the worlds of finance and digital come together, enormous value is unlocked, as you’ve hopefully gleaned from the examples above. When done correctly, it’s a rare and true win-win-win for the embedder, business customer of the embedder’s app and the end user.

3. Embedded finance brings down barriers to financial services

At Weavr, our mission is to not just be part of the rise of embedded finance, but to help drive it forward by being the easiest and safest way for non-financial businesses and banks to deliver embedded financial services at the point of need. The more we can bring down the barriers for embedders, the closer we can get to a world that reaps the benefits of seamlessly integrated financial and digital services.

This isn’t just about a better customer experience – ease also means improved access.

Embedded finance enables a greater number of people to understand and benefit from financial services, since they access them in the context of activity they are already carrying out. It means more people accessing financial services and more financial services being offered in more places. Both expand the market. Consumer Duty concerns will need to be taken into account here to ensure good outcomes, but, done well, embedded finance can enable the democratisation of possibility.

This is also true for embedders. Embedded finance unlocks opportunities for more platforms to fulfil their true potential, giving them access to a kind of financial innovation that was previously locked behind a legacy banking system.

By creating a tight connection between user context (booking a taxi, managing suppliers, etc.) and financial products, embedders have the opportunity to learn from a new kind of feedback loop. This enables them to innovate and iterate on financial services at digital speed.

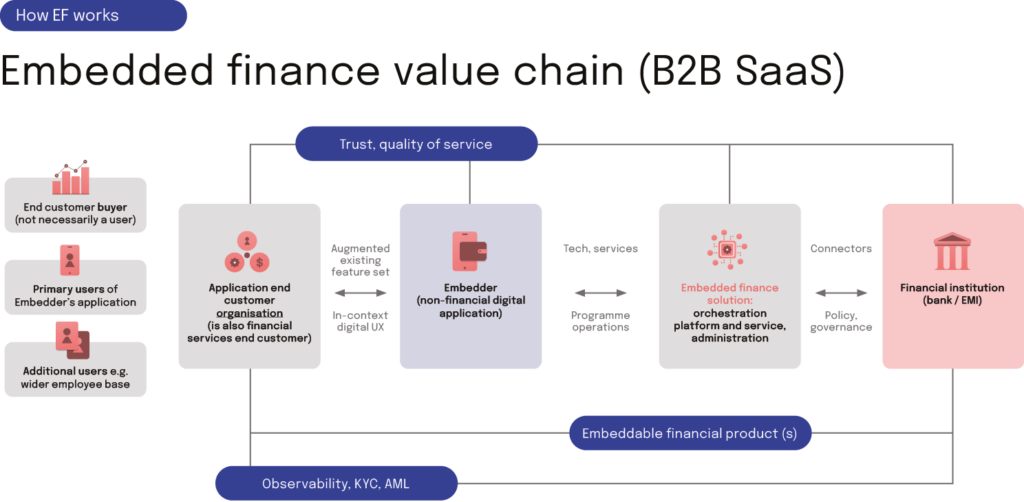

How does embedded finance work?

1. Embedded finance starts with a use case

We can’t talk about how embedded finance functions unless we start with the end customer. That’s something everyone else in the value chain should remember at all times. There’s a lot of cool (and mundane) things that embedded finance can do, but it’s not really relevant unless it meets the needs of a user. And specifically a user with a job that needs to be done.

So let’s say we have a user with a job that needs to be done. Traditionally, you might think of that job as a pain point or desire. And whether they’re assigning their marketing budget on a project-management system, or trying to calculate their tax returns using specialist software, there’s a chance for embedded finance to do the job in a smarter way.

If the user’s objective is primarily non-financial, but involves money, it’s likely an embedded finance use case. For instance, you could have an application that helps people to compare and select university courses. Applying for the right university course is primarily a non-financial objective, and yet it does involve money because applying to university requires loans and other expenses. That makes it an embedded finance use case and, so you could explore the question “how do we surface a branded, in-app student loan offer that will help a user in the process of comparing university courses?”

2. Embedded finance needs specific capabilities

Once you have an embedded finance use case, you need the capabilities to fulfil it. And that depends on two factors:

- You need an embedded finance solution, composed of:

- An embedded finance platform: the platform orchestrates embeddable financial products, such as a loan or an account capable of financial transactions.

- The expertise to run the platform: depending on the design of the platform, technical and engineering knowledge may be sufficient, or you might also need financial and regulatory expertise. Elements of this expertise may be supplied by an embedded finance provider.

- Financial service providers that support the platform: if you partner with an embedded finance provider, they will already have partnerships with these financial institutions.

- All the above components need to work in a way that regulators are happy with, a challenge that very few companies have managed to overcome.

There are two limited ways that companies have managed to make the above work, although these are imperfect and flawed.

- Fintechs or banks create and run the entire system, using their existing partnerships, technology and expertise. For instance, a fintech company that provides student loans might opt to make a university course-selection app that surfaces these loans in a non-financial context.

- BaaS providers supply some of the components a non-financial company needs, such as a financial licence. This comes with complexity- and scalability-based limitations as well as risk, since the BaaS provider never provides everything the non-financial company needs, and few companies can make up the difference.

In either scenario, embedded finance only becomes viable for companies willing to invest many years, and a seven-or-eight figure sum in order to make it work. The company will essentially need to become a fintech company, if it isn’t already.

This is only an arrangement that companies as large as Uber or Shopify or Amazon can afford. And any arrangement that isn’t watertight can lead to trouble with regulators, as experienced by BaaS providers like Railsr, Solaris and Varengold.

There is another way to make embedded finance work, which we have pioneered at Weavr. A way for embedders to have a scalable business that can add financial capabilities without becoming fintechs.

Based on our experience of working with non-financial companies, we’ve designed an accessible platform that can be used in a regulation-compliant way by companies with limited or no financial expertise. As far as we know, we’re the only ones making embedded finance work like this, and in our experience it’s the only way for regulators to feel happy with embedded finance as a workable solution.

What are examples of embedded finance?

Embedded finance might be new, but there are already several examples of it to be found in the world – many of which you might have used today without even realising. We’ve already mentioned Starbucks – you can also find it in the seamless payment experience you get when booking a Lyft or Uber, or when ordering through Amazon.

Typically when we’re talking about embedded finance, we’re talking about embedded payments, but other examples also include embedded insurance, lending, saving, investing, personal finance management and DeFi and cryptocurrency products.

Here is a selection of Weavr embedders giving great examples of how they use embedded finance

We’ll take a look at more example use cases below and, if you’d like to go over employee-directed use cases or business-payment uses, take a peak at Weavr’s solutions for even more. The latter aren’t the only use cases for embedded finance, but they cover areas where we’ve seen embedded financial services repeatedly for platforms and their users.

Or if you’re confident of your use case, the next logical step in your embedded finance journey is to check out our helpful “Embedded finance – a buyer’s guide“. Filled to the brim of handy information to ensure you don’t get lost down rabbit holes of research.

Use case summary: employee benefits and expenses applications

With embedded finance, you can support employee-directed financial transactions within your B2B SaaS application. You could enable your users of your application to:

- Axe painful bureaucracy through pre-defined rules and automations

- Reimburse approved expenses faster, again through pre-defined rules and automations

- Process equipment purchases with full autonomy, using pre-allocated budgets

- Discover, claim and receive employee benefits within a self-service, one-stop shop

- Give and receive rewards in the form of cash or allocated amounts to spend on certain things

For example, Weavr’s Plug-and-Play Finance solution currently powers NUMARQE’s corporate card platform, which extends credit lines to businesses to enable faster, more streamlined purchasing and procurement. With Weavr’s embedded financial services, NUMARQE can offer employers real-time card management, spend controls, simplified expense management and credit facilities in multiple currencies.

Use case summary: business accounting and payments products

Embedded finance enables you to embed payments capabilities within B2B applications, such as invoicing, accounts receivable, factoring or SME lending, procure-to-pay and spend control, or cloud accounting and financial insights.

For instance, embedded finance could enable your users to:

- Bring payments inside the apps where they’re already reporting on or analysing money, e.g. a cloud accounting application that can also move cash, not just watch it

- Automate more manual tasks to reduce costly errors

- Buy and sell products or services with other businesses within your platform

- Benefit from automated reconciliation within your procurement platform

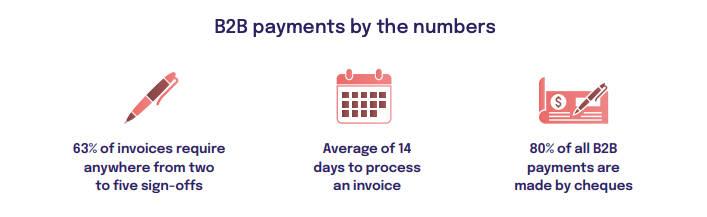

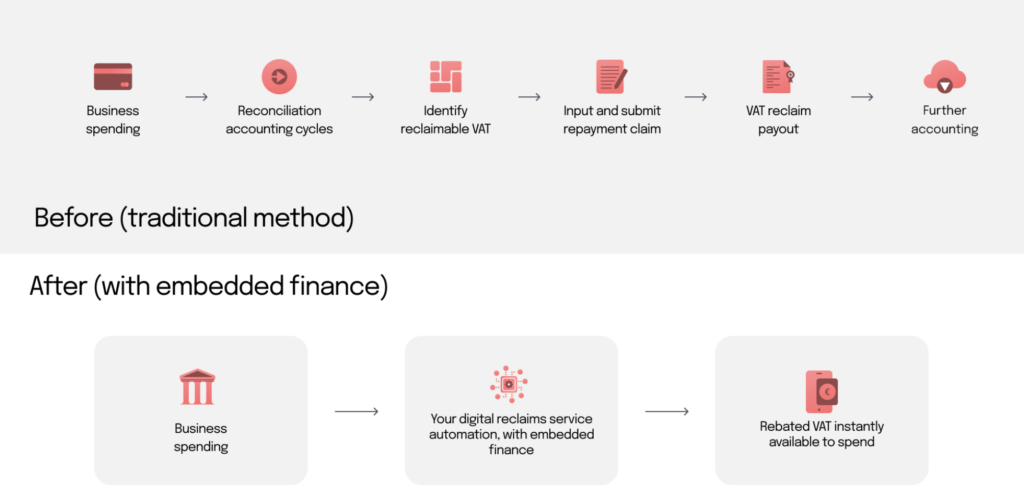

B2B payments can often be slow, cumbersome, paper-based process, with companies who buck the trend of traditional approaches able to realise competitive advantages. Let’s take a look a typical accounting process where VAT is reclaimed and compare it to what it could be instead once embedded finance has been add in:

Use case summary: freelancer and worker platforms

As well as employers and their teams, embedded finance can also power solutions for freelancer and contractor commerce. Weavr solves for a variety of use cases that help freelancer platforms boost digital user engagement and loyalty from freelancers, creators and influencers by embedding valuable financial features within the context where they find work and earn money.

For instance, embedded finance could enable your application users to:

- Manage dynamic flows of earnings from digital sources e.g. sponsorships, fan subscriptions, and royalties

- Get instant access to earned funds and choose how to spend or withdraw them

- Set project or task-payment criteria that protect buyers and sellers of services

- Take advantage of incentives to recirculate funds in your marketplace

How is embedded finance revolutionising financial services?

We’re just at the beginning of a multi-decade transition away from the traditional banking and financial services model. Embedded finance is part of this revolution that customers started, and industries are adapting to customer demand.

Already, if you’re Generation Z, you’re more likely to think of Revolut rather than Lloyds when you think of banking, even though Revolut is a fintech, not a bank. And over the next few years, embedded banking is going to change the population’s perception of finance even more.

Thanks to embedded finance, tasks that you used to only be able to complete through your bank, you can now achieve through a new breed of cloud apps, with financial features that now sit in the context of accounts payable, procurement, accounts receivable, payroll, accounting, finance ops, billing, expenses, subscriptions and so on.

If you’re an employee, instead of claiming expenses through a lengthy, cumbersome process, you simply open up an expenses app and press a button to order what you need. Or if you’re a finance professional, instead of requesting payments from a financial controller, you just hit “pay now” using an app that has predefined parameters for approved payments.

Essentially, the effort of the task becomes effortless, and the financial process becomes invisible.

- Buying a car: instead of applying for car finance, you’re just buying a car.

- Imagine if a loan that the application knows you’re eligible for (as they know who you are already and define logic around it) is offered as a natural step in the purchase process

- Going on holiday: instead of getting travel insurance from a provider, you’re just booking a trip on a travel app.

- Imagine if, instead of making a claim retrospectively, your travel app recognises your flight is delayed and offers to book you into a nearby hotel. Maybe it also gives you £50 to spend on food at the airport, and an extra £10 to buy your child a treat, since it knows you’re travelling together.

Digital applications already have the power to know a user’s exact context – their precise location, schedule, contacts, budgets, purchase history, and so on. Now that context can be used to provide exactly the right financial product at the point of need, in a way that’s totally seamless.

As a result, embedded finance explodes the availability of financial services. No longer do people need to obtain them directly from financial institutions. Now they can consume them at the point of need and within the applications they use in their daily digital lives.

And just as people don’t want to go back to booking taxis the way we did in 2005, customers will never want to return from other embedded finance experiences once they’ve tried them.

What about the future of embedded finance?

In a webinar with The Fintech Power 50, Polly Jean Harrison, a reporter from Fintech Times, initiates discussions surrounding the current and future digital banking landscape, along with the trends gaining traction.

With the use of digital banking services growing exponentially in the last few years, the industry is continually reinventing itself. Consumers can now access banking services from anywhere in the world at any time, with the ongoing transformation of banking becoming an industry standard.

Polly and the panelists, including Weavr’s Chief Commercial Officer, Daniel Greiller, also explore the challenges currently facing players in the industry and what the future holds:

The full The Power 50 webinar can be found here, and is worth a watch.

When we think about the future of embedded finance, let’s imagine use cases that might not feel right now but could definitely feel “coming soon”.

One of them has been put forward from the the design user-experience collective over at Thunk, who have worked out an interesting concept prototype utilising embedded finance. How about “Buying a Big Mac with one tap using a Tesla” – does this sound too futuristic to you?

See it in action and take a look for yourself – want some fries with that?:

Enjoyed this? Let’s look at the next chapters…

Ultimately, embedded finance is finding new examples and use cases every day. Soon it will be possible to map out your average day through its touchpoints with embedded financial services – from your morning coffee bought directly from a rewards app, to booking and paying for your ride to work with one press, to the suite of digital SaaS platforms you use when you get there. In most cases of truly seamless integrations, you won’t even notice it’s there, right?

Whether your offering is an application, marketplace or platform, if you’re looking to embed finance into your business, set up a meeting with one of our experts in your industry and request a demo today.

Additionally, these longer read books below can be downloaded to extend your review of the variety of use cases and business opportunities for embedded finance. Also, they’ll give you great insight into the considerations you might need when implementing embedded finance.

UK Consumer Duty should be taken into consideration. For lending, this should be licensed as applicable.

Do you want to know more about the compliance considerations when embedding finance? Great! Talk to one of Weavr’s experts today.