Delve into our latest market research on how the UK finance and banking sector appraises the opportunity of embedded finance for banks, as well as the actions they’re taking to develop their own offerings. We provide the 30,000-foot view on the research findings below as well as the option to download the first two parts of the in-depth analysis right now.

Video: what is embedded finance for banks and what’s key to building a successful programme?

Take a few minutes to hear the perspectives of Alex Mifsud, Co-founder and CEO, and Daniel Greiller, Chief Commercial Officer, at Weavr on why banks should prioritise and act on the embedded finance opportunity now:

Alex and Daniel share their views on embedded finance for banks and cover key topics, including:

➯ What can banks achieve with embedded finance?

➯ The main use cases to explore

➯ The key players in a successful embedded finance partnership

➯ How product and innovation teams should approach embedded finance

➯ How Weavr works with banks

➯ How this is not just “more Banking-as-a-Service”

➯ The imperative to act now on embedded finance

White paper: UK banking and finance executives point to both high awareness and action on embedded finance for banks

Embedded finance is a new set of models and technology but it’s already a widely discussed topic among innovation, growth, and product leadership in banks. Some have made impressive early moves in targeted areas such as BNPL but, for most banks, it’s still early days for real-world product and partnership development and, beyond that, of visible go-to-market activity.

Until more public case studies emerge, some might accept the idea of a “wait-and-see” posture on embedded finance. But we think it would be a mistake not to get ahead of this opportunity.

Findings of the research:

Most banks are already aware of embedded finance as an opportunity:

… and are already active in research and development in this space.

Banking executives across all roles are frequently in conversation about embedded finance at work…

… and embedded finance is predominantly agreed to be something different to Banking-as-a-Service.

Banking executives are readily able to anticipate a broad range of costs and risks they will face when building and rolling out embedded finance capabilities…

…as well as evidence that both strategic and planning uncertainties accompany the general enthusiasm and activity levels…where in combination these challenges may already represent a risk of delay or even failed execution of embedded finance innovation.

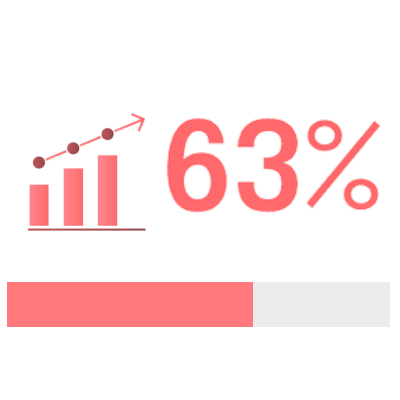

Almost two-thirds (63%) of surveyed executives in UK banks and financial firms consider embedded finance a consider embedded finance a significant commercial growth opportunity for banks

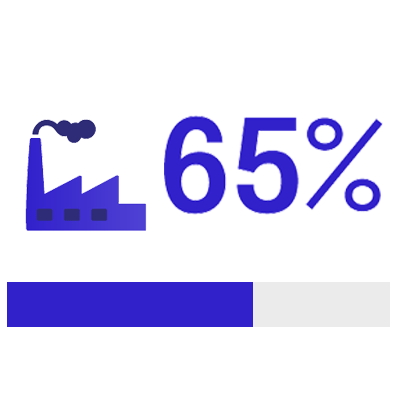

As well as agreeing it’s a commercial opportunity, two-thirds (65%) of UK banking and financial executives state that their business is already active in embedded finance research and development

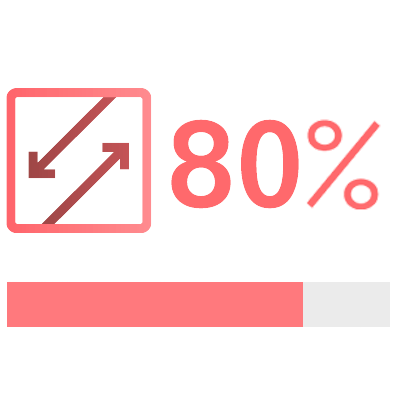

Four out of five (80%) of UK banking and finance executives consider “embedded finance” means something different to “banking as a service”

If the indications from our UK banking research can reasonably be extrapolated across Europe, if not globally, there is actually a hive of activity on embedded finance innovation in banks behind closed doors. Once more projects start to come to fruition, this is likely to create a virtuous cycle of interesting new public case studies for bank-driven embedded finance, and in response further competitive innovation from the industry over the rest of this decade.

“There is actually a hive of activity on embedded finance innovation in banks behind closed doors”

Alex Mifsud, CEO and Co-Founder at Weavr

Download the white paper for 40 pages of in-depth analysis on embedded finance for banks

In the white paper, we lay out our recommendation that teams in banks should “roll up their sleeves” and get up to speed on embedded finance as fast as possible, building on open innovation patterns that have worked well for the market leaders in mobile banking and open banking.

From early digital banking through to mobile banking and open banking, some financial institutions surge confidently ahead while others are caught on the back foot and have to address the trend reactively. Even if you are not sure of your organisation’s state of readiness, you can bet some teams close to you are already working on embedded finance… and your competitors certainly are. If we have to pick one takeaway from this white paper it’s that you want to join this race on the front foot, and learn by doing.

Read more from Weavr or talk to an expert

If you enjoyed this guide, why not check download a copy of the white paper for yourself by clicking here or speak to one of our team today about how we can help you and your business?