- Introduction

- Today's B2B payments industry

- The pandemic and the B2B financial landscape

- How businesses at the frontier use embedded finance

- The benefits of embedded finance for supplier payments

- Embedded finance use case examples

- What embedded finance offers

- Vertical benefits of embedded B2B payments

- How NUMARQE unlocks corporate credit through embedded finance

- Why plug-and-play finance is a game-changer

- How to embed finance into your business

Efficiency, automation, and convenience are what businesses expect from their operations and technology these days. But are payment processes evolving as fast as businesses want? In this guide to embedded finance for business payments, we’ve taken a quick look at the latest trends and changes in business-to-business (B2B) payments. In doing so, we sought to see where the opportunities might be for businesses to implement embedded finance in supplier B2B payments.

We offer three ways in which the B2B payment experience can be radically transformed to give enterprise resource planning (ERPs), accounting tools or order management platforms a huge competitive step-up. They are in more detail further on – look out for ‘Uniting invoice processing and payment under one system’, ‘Shrinking the margin for human error’, and ‘Empowering budget owners’.

In this guide to embedded finance for business payments, let’s explore trends shaped by recent events, advances in technology, and how disruptive solutions such as embedded finance are becoming available to the more ambitious early adopter.

1. What’s happening in today’s B2B payments industry

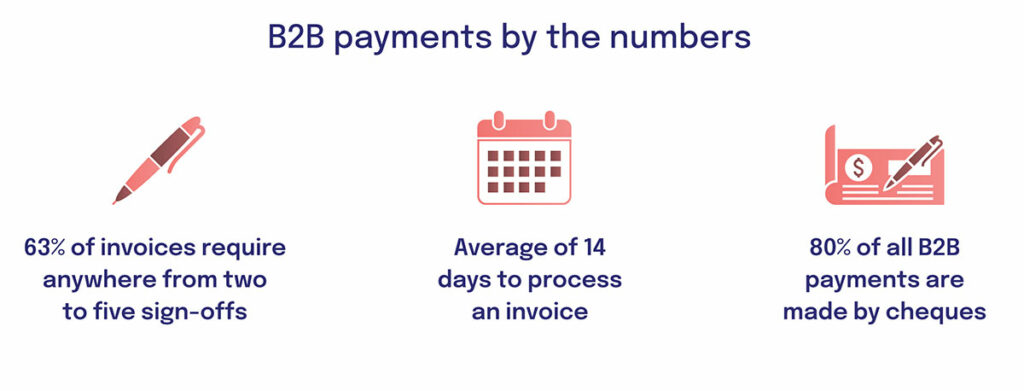

The difference in customer experience between B2B and business-to-consumer (B2C) is vast. The customer experience has diverged, with B2C becoming easier but business payments seemingly as difficult as ever. Why is that? Because B2B payments are more complex than B2C payments and processing requires more time to approve and settle, with more stakeholders and risk if things go wrong. Processes traditionally designed to limit risk also prevent seamless and instant workflows.

For example, in the business world, we might place an order digitally but not receive an invoice with payment terms until days later. This then adds to the always-growing pile of admin tasks needing to be done by month’s end. Whereas in B2C payment processing, the transaction is typically settled on the spot and the experience has never been slicker.

Traditional approaches to finance management have been disrupted for small and medium-sized enterprises (SMEs) by multiple new digital-only services that think more about convenience and digital UX design – the likes of Xero, Freshbooks, Chargebee, and FreeAgent. They’ve radically improved the ability of SMEs to get a grip on their book-keeping, AR/AP, and financial controls. However, when it comes to moving money, these platforms still typically require users to hop out and manage cash and payments how they’ve always done it – in their bank.

Dealing with these basic financial needs within a bank’s app or portal offering (to say nothing of phone banking or going to a branch in person) is likely to feel limiting compared to the choice, convenience, and control that SMEs have come to expect from their non-bank cloud-based tools. Most traditional banks have stayed within a fairly limited definition of what they can provide, and aren’t innovating nearly as fast as the non-bank fintechs.

Now the situation is getting even more interesting because it’s not only financial and accounting applications targeting bank-like functionality, but a wider range of SaaS business tools. These tools are accelerating the process of “unbundling the bank” that was started by the fintechs.

2. How has the pandemic shaped the B2B financial landscape?

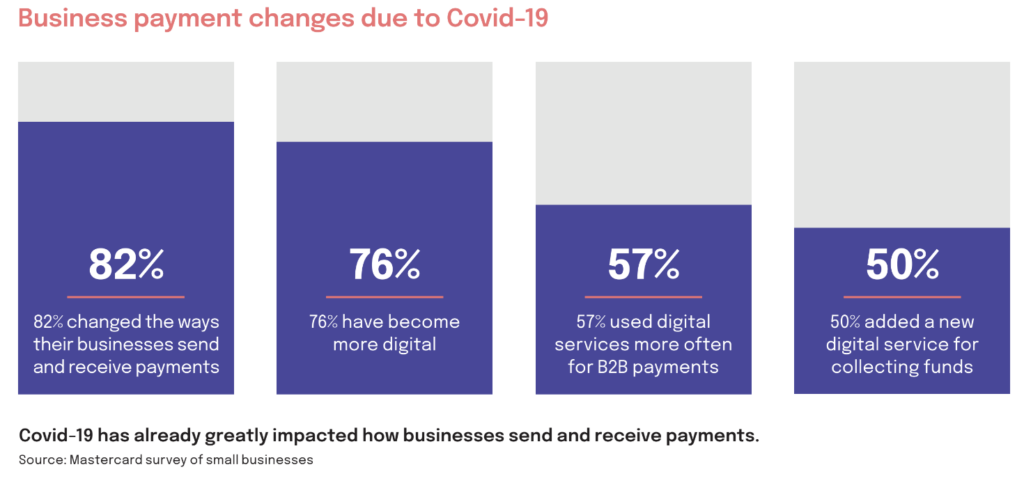

There’s no doubt that businesses have upped their digital game since the start of the pandemic. Entire workforces were forced to work from home. The businesses that thrived rather than struggled were those who took advantage of the most remote- work-friendly tools. Those who got people set up with Zoom (“you’re on mute!”), or utilising project management tools to aid productivity, like monday.com or Asana, and not forgetting Slack or Microsoft Teams to ping a colleague a quick question or GIF.

Think back to using project management platforms and when your company interacts with third parties. Invoices are often part of that process. What if the payment of those invoices could also happen within the platform? Company-wide visibility of everything, all in one place, actions made behind the scenes, and automation taking care of some of those laborious admin tasks. It would be much handier than separately logging into the bank account, making payment manually, and documenting it in a spreadsheet (that no one in the company can ever find when needed).

However, the question still remains “how many of these offer good financial tools or plug-ins”? Currently not many, even with the advances. Paying for something still requires taking out that plastic card (or – gasp – borrowing “The Business Card” from someone else), then waiting for an email to authorise. It’s a clunky process in the B2B payments world.

Product managers at B2B app and platform innovators are now addressing a much more receptive mainstream market for anything they can offer that helps businesses progress their digital transformation strategy via a more B2C-like experience inside business workflows.

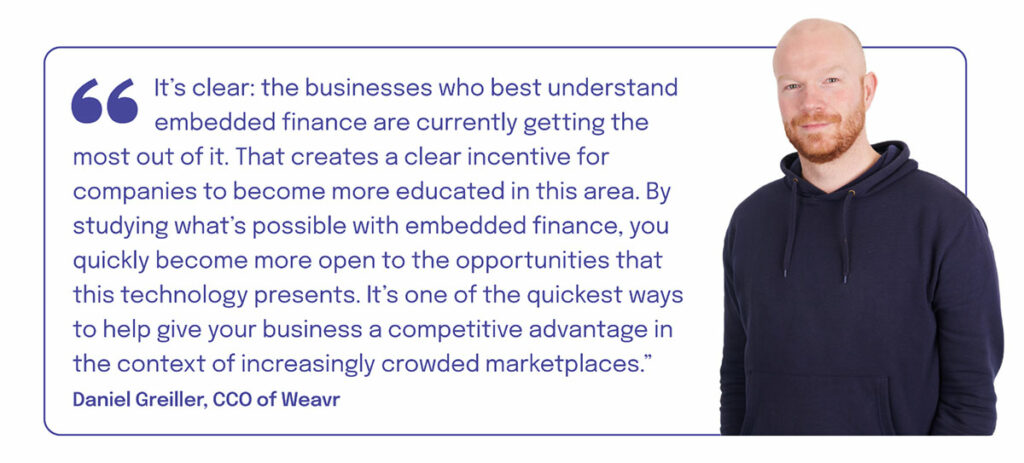

3. Smarter payments: how businesses at the frontier are using embedded finance

Innovative platforms like finway have embraced embedded finance to transform how B2B payments are made. Finway is a powerful tool for SMEs that enables back office teams to manage accounting, keep track of budgets and process invoices with automated workflows. With Weavr’s Supplier Finance Plug-in (see below for a quick explainer), they can then go one step further to link up their bank account and issue payments from one holistic system.

There’s a huge opportunity for more SaaS back-office platforms to plug financial tools into their offering, whether or not their existing functionality focuses on payments or accounting.

4. What are the benefits of embedded finance for business payments?

Adding financial services to a digital application leads to benefits right across the customer lifecycle. That’s why 73% of businesses intend to embed finance in the next 2 years.

(Source: OpenPayd survey, FintechTimes):

Sharpen customer acquisition

85% of companies that implement embedded finance say it has helped them acquire new customers. A richer experience is more appealing. In turn a richer experience contributes to improved lifetime value and lower churn.

(Source: OpenPayd survey, FintechTimes)

Multiply your revenue per user

The financial services a business adds to their application are monetisable. For example, the business can add a fee to process payments, issue cards or any other service to their customers. Rather than being a cost centre, embedded finance can be a considerable growth driver.

(Source: a16z)

Valuable data and customer insights

When you own the financial part of the customer journey – rather than sending the customer to the bank – you can understand how your customers transact. An example would be aggregating the spending patterns and examining them by demographic to gain a powerful set of insights that guide product development and marketing.

5. Embedded finance use-case examples for business payments

Examples from well-known companies using embedded finance

George Baily, Product Marketing Lead at Weavr.io, uncovers how traditional businesses can evolve into profitable fintech platforms through embedded finance in the short video below. Echoing Angela Strange’s belief that “every company will be a fintech company”, we see this trend and use cases manifested in giants like Apple, Uber, and Starbucks. These companies have significantly elevated the consumer experience by seamlessly incorporating financial services into their operations.

The video was taken from a Weavr webinar, “Embedded finance: the next wave of disruption in B2B”, you can access the full recording here. The panel includes Sophie Guibaud, embedded finance expert and Rick Farrell, UX expert.

Here are five use cases where embedded finance can offer the solution to everyday business woes.

1. Uniting invoice processing and payment under one system

One of the biggest frustrations with back-office SaaS solutions is that they often feel incomplete. They’re designed to make processing invoices and paying suppliers easier. The platform they use might pull in their bank account details so that they can see their cash position and movements in and out. But when it comes time to make those payments it means opening up another window, logging into a bank and filling in all the correct account numbers and amounts manually.

2. Embedded finance can sew that entire journey up in one place

When invoices come in, cloud accounting and bookkeeping platforms can match up the reference numbers and reconcile everything. However, embedded finance could then offer the ability to pay with a single button. The payment process becomes simple, and no time is wasted by moving between multiple portals. It’s not just about a better joined-up experience for the end user. An accounting platform could increase their revenue per user by monetising the flow of money that’s now taking place within their platform. a16z VC state that the revenue opportunity exists to at least double per user.

3. Shrinking the margin for human error

When large sums of money are moving from one business to another, accuracy is critical. One number is all it takes for the wrong amount to be paid out, or the right sum to reach the wrong account.

It might sound like a rare slip-up but it happens all the time. Research by Versapay revealed that more than 80% of c-suite executives at large companies say they have lost revenue as a result of miscommunication causing invoice disputes. And according to 92% of those executives, the answer to solving those human performance issues was digitising the process.

4. Payment and SaaS: a marriage made in heaven

The more manual steps there are, the greater the chance of those costly human errors occurring. But when payment and SaaS are integrated into one platform, those steps can be automated. Embedded finance can help here by removing the manmade mistakes of miskeys and more.

With embedded finance powering automations, there’s no need for a back-office team member to copy across account numbers and invoice amounts every time a supplier needs to be paid. To put a fine point on it, it means that the risk of mistakes sending money to the wrong place is vastly reduced.

5. Removing repeat processes humans must complete

To licence software tools and digital services within a budget, a manager or team may have to request permission at least four or five times. These permissions can be: in the original budget planning, to create a purchase order, to approve paying the resultant invoice, repeating those steps if figures or deliverables got changed, and then to execute an actual payment, not counting any later reviewing or reconciliation steps.

Every single payment is fraught with administration, resulting in costs, delays, and complexity around even simple requests. Paying for digital products and services is typically about finding a way for the business to move faster. In practice, all the bureaucracy makes businesses move slower and incentivises lower quality, less scalable “free” solutions. These solutions can also include costly DIY approaches.

Business cloud tools can fall short – lots of smart digital tools offer ways to join up processes and expand functionality by tapping into an ecosystem of apps and integrations. However, these are not usually free. Even if the original platform (e.g. a CRM or workflow building app) is licenced, there’s no way to tap into that payment method to add authorised charges to a bill.

6. What embedded finance offers for business payments

A platform provider could encourage business users to set up their billing via a branded payment account with an attached card. They could then offer ways for a company to allocate funds to particular business units or staff. They could then use these funds to pay for add-ons or recommend new tools in a marketplace or referral model.

Tools that were merely used by the business to plan work or hold conversations about digital tooling and budgeting could now be used to empower teams. These tools can actually acquire and set up their choice of tools, within safe limits set by the business, virtually eliminating the drag of legacy payment approvals bureaucracy.

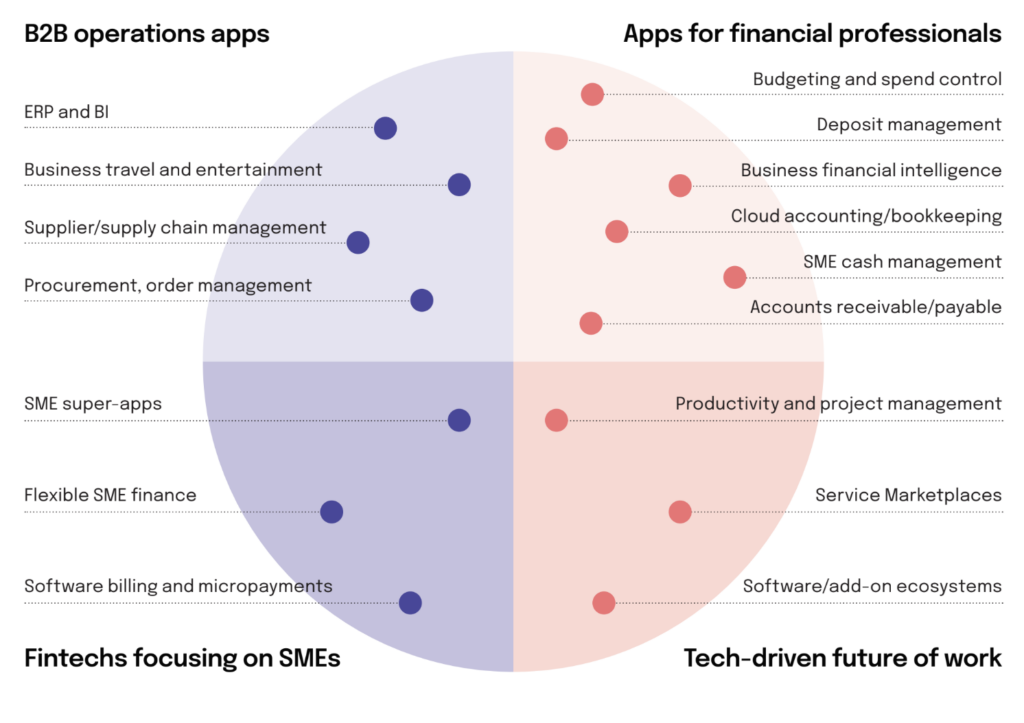

7. Which verticals are going to be the first to benefit from embedded B2B payments?

Whether or not competitors in your space are already using embedded finance to stand out from the pack, disruption is coming to your industry.

When looking at B2B payments, our research sees the most quickly transformed verticals being those where businesses are already dependent on digital tools for tracking financial data such as cloud accounting platforms. In these applications, adding cash and payment accounts makes a lot of sense in terms of the speed and sophistication of functionality that innovators can add.

Looking more broadly around business tools such as productivity and collaboration software, and ERP-type functions, it’s the areas where analogue disconnects cause costs, inaccuracies, and delays that will be targeted by embedded finance innovators in the next couple of years.

Innovators in non-financial spaces can help their users extend efficiencies into workflows that involve cash and payments, and by doing this they can differentiate their application and add new revenue streams for their business.

8. How NUMARQE unlocks corporate credit through embedded finance

NUMARQE’s innovative multi-currency credit platform harnesses the power of AI to enable real-time underwriting of credit risks, make intelligent lending decisions and efficiently allocate credit to its customers. This allows NUMARQE to offer corporate businesses fast access to credit and with higher credit limits than they’d be offered elsewhere. Whilst also providing more flexibility in how they spend against their credit line. With NUMARQE’s solution, corporations can be onboarded in as little as 20 minutes with instant access to a credit line and corporate cards.

By combining the power of AI to enhance risk decision-making with Weavr’s Plug-and-Play Finance solution, NUMARQE now offers real-time card management and spend controls alongside tailored credit facilities in multiple currencies. The suite of services also includes secure online payments with virtual cards, enhanced business intelligence with spend insights and analytics. In building this suite of tools, NUMARQE gives companies total transparency over corporate spending, offering more control to Finance managers than ever before.

With a Weavr-powered card, NUMARQE also simplifies expense management, allowing Finance teams to create an automated feed or export transaction-data files in journal format to post into accounting software. The platform can reconcile digital receipts directly from the merchant with each transaction. As a result, enterprises can manage and track their team spending with instant visibility.

Weavr was the obvious partner for NUMARQE because of the company’s intuitive and easy-to-implement solution. Unlike the alternative of having to piece together a solution from multiple vendors and financial-service providers, Weavr’s platform can be integrated in a matter of weeks and at a fraction of the cost of traditional Banking-as-a-Service providers. This speed to market has enabled NUMARQE to respond quickly to the financial needs of its customers.

“Our multi-currency credit platform is designed to bring a major transformation to traditional credit offerings, providing corporates with a committed, unsecured credit line at their disposal, which can be seamlessly allocated across all their corporate spend. This makes it incredibly easy and efficient for CFO’s and Finance managers to manage their working capital, whilst retaining complete transparency and control of company spend. From day one, we valued Weavr’s tech-first approach to problem-solving and the benefits it could bring to our platform. The company stands out as a true innovator that understands our customers and are wholly committed to helping other innovators grow.”

James Bowler

CEO, NUMARQE

9. Why Plug-and-Play Finance is a game-changer

Core to Plug-and-Play Finance is the understanding that our customers will be better equipped than any payment provider to create solutions to real-world challenges. It’s then Weavr’s role to give easy enough financial services tools to augment their proposition.

A key aspect of Weavr’s mission is to enable any digital application to integrate financial services that can create value for customers.

The result? Improved customer experience is great for users of the application. For the business, they also have the opportunity to multiply their revenues.

Weavr’s Plug-and-Play Finance gives your business the ability to design and launch products at short notice, which is essential in today’s fast- paced world. That’s not the only benefit, Weavr is the fastest and most cost-effective option for any business wishing to embed finance and validate its impact.

Faster to build

Gain immediate access to the complete package you need for your business model, so you can get to your first live transaction 10x faster than any other approach

Easier to run

Secure, scalable SaaS platform behind unified interfaces means you can run and grow your business without worrying about building your own fintech ops team

Designed to evolve

Weavr plug-ins help you stay agile with clear versioning and change management, and new fintech capabilities added regularly. Scalable including global product offering and automatically updated features with every launch

Increased customer acquisition

85% of companies found embedding finance helped them acquire new customers

Multiply revenue per user

New revenue streams via rev share and fee charges. Embedded finance can more than double your revenue per user

Compliance as a service

We fully take on the burden of managing compliance, regulation and data security. You get to focus on building your core business

Your brand takes credit

All Weavr solutions are 100% white-labelled, so you maintain ownership of the customer experience with no distractions or brand dilution

10. What do you need to do in order to embed finance into your business?

In today’s fast-paced market, you should be able to easily, quickly and safely integrate banking features such as cards, accounts and IBANs into your UX and workflows. With this guide to embedded finance for business payments and with Weavr’s Plug-and-Play Finance solution, this has never been simpler because at Weavr we provide a fully-formed solution to plug in to help you implement embedded finance in business payments.

If you have found this guide to embedded finance for business payments useful then why not download our guide to embedding finance into B2B payment platforms or speak to one of our team today about how we can help you and your business?

Or perhaps you already know ‘what is embedded finance?’ and would benefit from a buyer’s guide with everything you want to know and what to expect as you commence your embedded finance journey.