Accounting and procurement tools promise the opportunity to wave goodbye to grunt work. However, no matter how slick and innovative your software offering, if it still leaves finance users poring over separate bank feeds when trying to process Accounts Payable, it’s probably falling way short on that promise.

Here’s a closer look at the often-frustrating reality of managing Accounts Payable; at what can make things better for users, and at a potentially feasible approach to level-up your existing products…

What’s wrong with Accounts Payable?

Accounts Payable is an area where the big promise of automation comes face-to-face with the reality of life for finance teams. The results can be a little – shall we say – underwhelming. Here’s what’s wrong with typical Accounts Payable workflows; and the faultlines that (for all their bells and whistles) accounting SaaS products too often leave unaddressed.

Fragmentation of systems

According to Sage, around half of finance professionals peg fragmented data and systems as the single biggest obstacle to getting things done.

It’s worth thinking about how this translates through to Accounts Payable processes. It’s true that any automated accounts system worth its salt lets users log, report, and generally play around with Accounts Payable transaction items. But as for actually paying those bills (a pretty important element of Accounts Payable in anyone’s book), that’s just not possible using the accounting app alone.

Payment operations therefore involve a depressingly old-school swivel chair procedure: eyeballing the balances and items on one system and screen (e.g. the user’s SME banking app) and comparing / manually reconciling it with a list of transactions on another system interface (your SaaS accounting product).

Data exports, manual data entry, reformatting, checking and rechecking: if your software offering still takes a no-can-do approach to in-app payment operations, then these inefficiencies remain a fact of life for users.

Imperfect visibility

That phrase – real-time visibility – is now so widely used in the finance software realm that it’s become almost a cliche.

From your users’ perspective, however, it’s an absolute imperative to be able to see precisely where their cash is, how much they owe, who they should pay (and in what order) – at any given time. In one recent survey, 62% of CFOs said that ‘understanding cash flow in real time’ has become more important in 2023. It’s pretty obvious that the disruption of the last couple of years has made up-to-date, accurate visibility over cash flow even more of a business priority.

Your accounts software paints a certain picture of cash flow for your customers. However, if the app does not incorporate payment operations, then the picture is very likely incomplete. To get an accurate snapshot of the here & now position, customers are required to reference multiple, fragmented systems: the opposite of true visibility.

Inefficient management of cash

Accounts Payable team members seldom relish receiving a ‘yellow alert’ corporate-overdraft message (something that’s invariably fed through to their superiors).

According to the accounts app, your user is good to go on paying a fleet invoice. But what’s the exact status and timing on an inventory replenishment order that’s apparently in the system and how will this impact the balance? Rather than the rigmarole of cross-referencing separate banking/accounts systems, the user errs on the side of caution and waits a day or two before executing payment.

Fragmented systems and an absence of visibility can mean that redundancies get baked into the process. Pots of cash may lie idle (‘just in case’). More capital tied up in this way means possible wasted opportunities in not being able to put it to better use. Worst case for your customer could be direct financial loss (failure to utilise early payment terms, for instance).

Status chasing

If real-time visibility on cash flow is lacking, then it’s more likely that payment execution is deferred. If this is the approach your customers take, then it’s going to have practical implications.

Prioritisation isn’t standardised to any meaningful degree. Invoices are settled later than they could or should have been, which means having to field more payment queries from third parties. It may also mean some awkward exchanges between your customer’s Accounts Payable team and other business insiders. For instance, a procurement manager is well-aware that the company’s finance team has just been furnished with new software. So why is she still getting the same-old excuses about waiting for up-to-date banking feeds in order to expedite payments to key suppliers?

Risk control

The ‘G’ (Governance) element of ESG is just as important as the Environmental and Social elements; something many of your users will be well-aware of (especially those who are in the market for investment). Lots of customers will be just getting to grips with the additional lease data management overhead ushered in with IFRS 16. Meanwhile, some of your enterprise-tier users may already be thinking about the likely reporting implications of UK SOX.

Why does this matter? It’s because right across your user base, factors such as security, accuracy, transparency, auditability, and management of sign-off hierarchies are very much live issues.

When your customer started on their strategy of greater automation and digital transformation, the desire to exert greater control over compliance risks was likely a key selling point. The notion that post-implementation, finance teams would still be required to jump from disparate systems for core processes: this possibly wasn’t in the script.

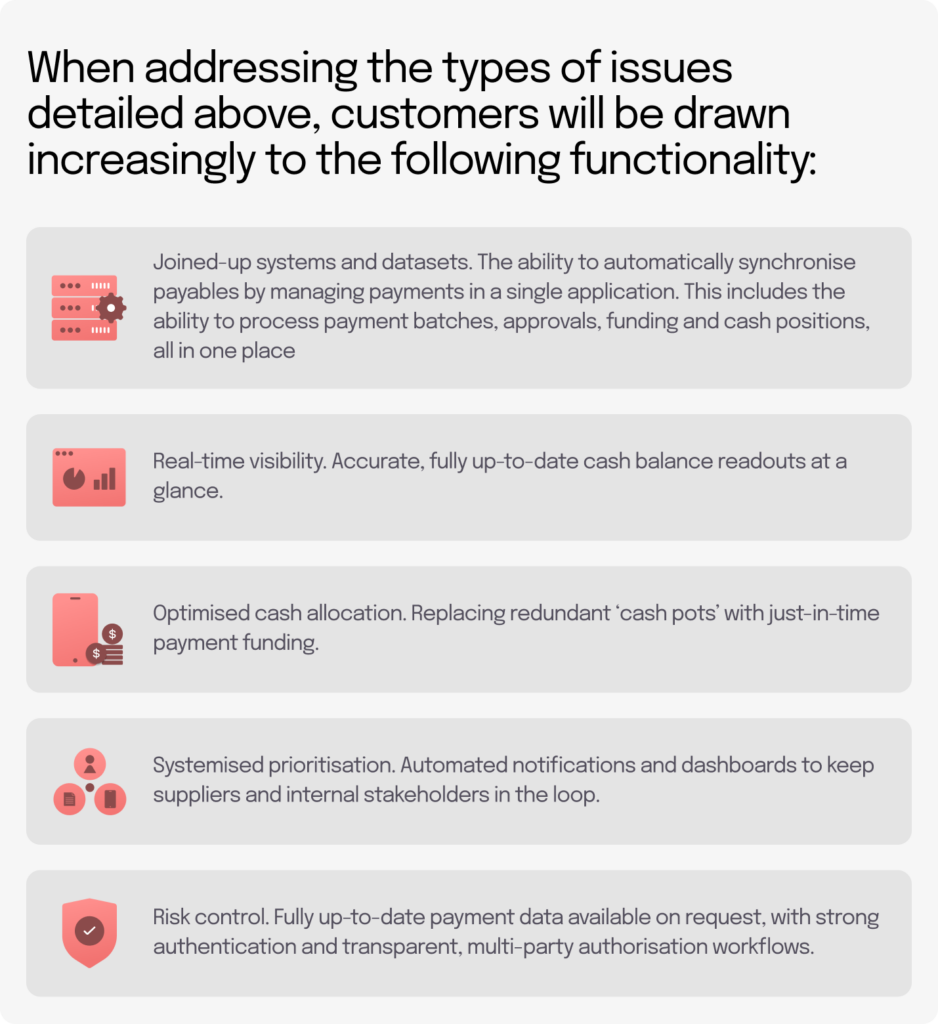

What do customers need?

Digital transformation is often characterised as a journey or ongoing process. In practical terms, this involves customers assessing what’s out there, and making the leap to a new platform if it is judged a better fit for business needs.

Can your platform promise payment runs without the pain? A complete payment-management service? Or the ability to sort, pay and reconcile invoices in seconds? Competitors can and, for any business-accounts product provider that fails to integrate payment functionality into their offering, there’s a clear risk of customer churn.

Making next-gen Accounts Payable functionality a reality

“We’re an accounts-solution specialist, not a fintech”. “An overhaul of our software is too big – and too risky to contemplate”.

If these statements characterise your current position on the integration of payment features into your product, there are two important things to bear in mind.

Firstly, with more and more cloud accounting tools offering integrated payment functionality, a narrow vision for your offering is likely to have a correspondingly narrow appeal.

Second – and most importantly, thanks to embedded finance, the introduction of the payment capabilities your customers are looking for is now in reach: minus the costly product overhaul.

Embedded finance for accounts payable

Embedded finance can be your Accounts Payable platform’s hero! The benefits of adding embedded finance are huge, let’s break them down very briefly:

- An enhanced user experience

- Increased user engagement and dependency

- A more attractive platform for users

- The ability to provide greater control and security

- Increased revenue and additional new revenue streams

If you’re curious about embedded finance for Accounts Payable, then please get in touch, we’d love to hear from you and help solve some of your Accounts Payable woes.

Or if you’d like to find out more about ‘what is embedded finance?’ and what it means for your platform, check out the ultimate guide to embedded finance.