- Introduction

- The new era of remote work

- How businesses can attract top talent with better tech and better incentives

- How work has changed for the post-pandemic employee

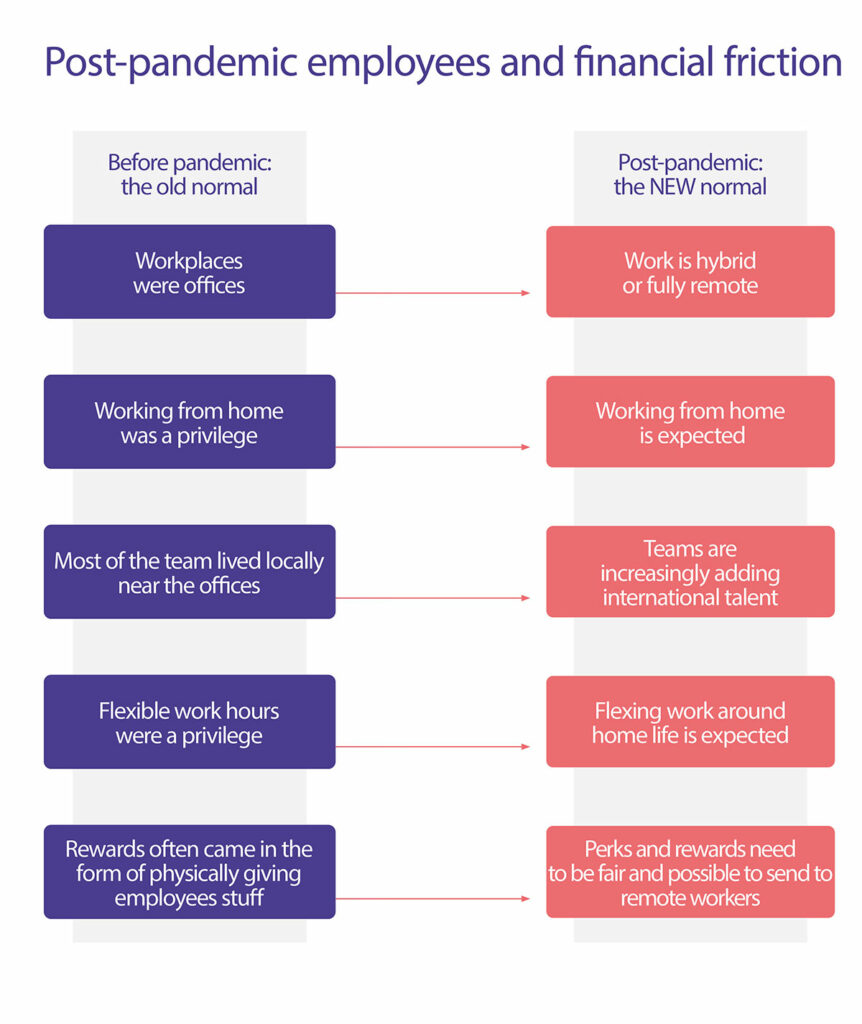

- Post-pandemic employees and financial friction

- How businesses are removing the finance friction using embedded finance for employee benefits

- What is embedded finance?

- How embedded finance enhances the workplace

- The fastest and easiest way to embed finance is with Plug-and-Play Finance

- Embedded finance for employee-directed applications

- Case Study: Embedded finance for an employee benefits platform

- What you need to build an embedded finance solution for workplace applications

In this guide to embedded finance in workplace applications, we will look at how employee empowerment, frictionless automations, and convenient processes are what’s expected in today’s digital world of work. We’ve looked at how the new era of remote and hybrid work has opened up opportunities for digital innovators to embed financial capabilities into their products and services. And why they’re more important now than ever before.

1. The new era of remote work

These days it seems like there are two increasingly incompatible responses to remote work, post-pandemic. On one side, organisations are saying “return to the office, resume business as usual” or the other end of the spectrum: “we’re all fully remote now, work anywhere”. Being on the fence with this is unhelpful, or worse because different teams or individuals inevitably establish their own standards and expectations.

Times have changed and there’s no ignoring it post-pandemic – that includes the ecology of work. Employee empowerment emphasises the importance of giving employees the autonomy, resources and support they need to act independently.

“In the wake of the biggest shake-up of workplace norms since the industrial revolution, organisations are scrabbling to keep up with the speed of change. Control has shifted from the employer to the employee, and with that businesses have had to step up their game at every stage of the lifecycle, from attraction and recruitment through to retention. Beer fridges and ping pong are not enough; the most effective businesses are making real structural changes to try to win the race for talent.”

David Collington, principal at barnett waddingham

“The Great Resignation” shows the sign of the shift in power to workers

Recently, newspapers and LinkedIn posts alike are awash with headlines featuring “The Great Resignation”. And for good reason: research shows a third of UK workers were considering a career change in 2022, and 2021 saw record rates of workers voluntarily quitting their jobs.

The pandemic and shift in power towards employees has enabled a shift in perspective for everyone, and more public dialogue about fitting work around life.

What was once important for employees has been swapped for things like physical health and well-being support, a tech stack that supports worker efficiency (no one wants to waste unnecessary time on those mundane tasks anymore), and the ability to work from anywhere.

2. How businesses can attract top talent with better tech and better incentives

A study conducted by Growmotely showed that 74% of professionals think remote work will become the new norm.

The same study revealed that having healthcare benefits (gym membership, medical assistance, and private healthcare) is the most sought-after perk for professionals moving into the remote era, followed closely by a desire for growth, learning, and expansion.

Employers who are able to integrate these benefits into their remote policies will be the first to attract top-quality professionals.

Do employers meet expectations?

Employee benefits are playing a more important part in employee retention and subsequently, turnover, if the business doesn’t match expectations.

3. How work has changed for the post-pandemic employee

In this digital hybrid world we find ourselves in, employee engagement is critical and businesses have to offer more to attract the best talent from around the world. But it’s not just about the perks and benefits on offer, it’s also how they’re delivered.

How easy are benefits for employees to take advantage of? And how annoying is the admin that comes with it all? Does submitting an invoice for your gym membership sound familiar? If you are or were an employee, it’s unlikely that your employer used a platform that gave you control over the benefits you wanted while removing the need for paperwork to prove you’d made a payment. But such solutions are out there.

It’s not just benefits

Think of all those things that need to be expensed – which has certainly changed in this new era of remote and hybrid work. It might be home office equipment or lunch when making the quarterly visit to HQ – paying for these with “The Business Card” borrowed from someone else is a long- way-around process and could be made much easier.

Post-pandemic employees and financial friction

4. How businesses are removing the finance friction using embedded finance for employee benefits

There are plenty of tools out there for employee benefits and expense management, which are often highly related. However, making the payments for work or well-being at the end of a process still typically means going outside of the software and logging in to a bank. And when the payments employees make aren’t so much a single invoice as frequent collections of receipts for ad hoc purchases, managing the admin is a time-draining chore.

As the power shifts from employers to employees, offering customisable perks, rewards, and allowances is essential to attract and retain top talent. Embedded finance can further enhance personalisation by enabling tailored solutions, improving employee satisfaction and outcomes.

The video above was taken from a recent webinar discussion, Luke Fisher, founder and CEO of Mo, and Daniel Greiller, Chief Commercial Officer of Weavr, explored the changing landscape of employment relationships and the importance of personalised work propositions and benefits. You can get full access to the webinar here.

Focusing a little on the expense-management side of things, what if a platform could not only make it easier for people to file an expense claim but also make the resulting payment automatically once approved? Or imagine if the package gave companies the power to issue cards to employees to make pre-approved purchases for their benefits, training, travel or research, all nicely connected up for ease of reconciliation.

The answer to both scenarios is embedded finance – seamlessly adding the required financial capabilities into expense management, employee benefits or any other platform.

What we’re seeing is when employees are no longer under the same roof and there’s a lot of complexity, innovative businesses are embracing the change and see new solutions for how digital systems can better connect and empower people.

Where a financial transaction is a natural part of the solution, embedded finance can super-enhance experiences for both employer and employee.

There’s a wave of nifty innovators – both big and small – who are tackling these opportunities and challenges to help employers offer more and employees do more. There are two shining examples of innovation that showcase how embedded finance can really be the game changer:

Ben offers businesses an incredibly flexible, all-in-one, employee benefits platform. Now, any company can personalise the benefits they offer, whilst significantly reducing the associated admin and simultaneously increasing end-user satisfaction. Seamlessly integrated into Ben’s platform, embedded finance enables businesses using it to manage the set of benefits provided to employees, issue branded debit cards to make payments, set budgets for employees and automatically reconcile all of the transactions.

finway makes financial processes in SMEs as simple and intuitive as they should be in a digital world. With embedded finance within the finway platform, the SMEs that use it can issue smart company cards (physical and digital) that can be used by employees to manage their spend efficiently – from subscription management to one-time payments.

We’ll look at them both in more detail in the “Employee financial empowerment: digital innovators at the frontier” section.

But first, let’s add more colour to embedded finance…

5. What is embedded finance?

Most innovators (that’s probably people like you by the way) rarely ask for ‘embedded finance’ when looking at embedding financial services into their products. It’s more the practical problems they are helping their users solve:. Problems with disconnects between business processes and financial processes, inefficient manual admin around payments, a lack of employee engagement with incentive schemes, and the inflexibility of dedicated banking and many more.

“Put simply, embedded finance is the placing of a financial product in a nonfinancial customer experience, journey, or platform”

Mckinsey & Company

Customers have high standards when it comes to digital interactions. They won’t stand for clunky processes, especially when it comes to the way their financial experiences are handled. Embedded finance enables software builders (you again) to:

• Design a seamless customer experience with money moving invisibly inside your platform

• Offer convenient payment methods including virtual and plastic cards, Apple Pay and Google Wallet

• Set budgets and controls for specific purposes, decreasing the chance for human error

• Automate reconciliation, which saves time and money – a win-win

What are the benefits of embedded finance?

Adding financial services to a digital application leads to benefits right across the customer lifecycle. That’s why 73% of businesses intend to embed finance in the next 2 years.

(Source: FintechTimes)

Sharpen customer experience

Demand for embedded finance will grow because the “better together” proposition promises to improve customer experiences and financial access, along with providing cost reductions and risk benefits to companies.

(Source: Bain & Company)

Multiply your revenue per user

The financial services a business adds to its application are monetisable. For example, the business can add a fee to process payments, issue cards or any other service to their customers. Rather than being a cost centre, embedded finance can be a considerable growth driver.

Valuable data and customer insights

When you own the financial part of the customer journey – rather than sending the customer to the bank – you can understand how your customers transact. An example would be aggregating the spending patterns and examining them by demographic to gain a powerful set of insights that guide product development and marketing.

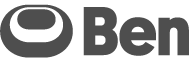

It’s happening right now at Shopify

Embedded finance, not subscriptions, are the secret to Shopify’s growth. Shopify brings financial services into their platform to make doing business easier for their customers:

Embedded finance, not subscriptions, are the secret to Shopify’s growth. Shopify brings financial services into their platform to make doing business easier for their customers:

• Shopify Pay (one-click checkout)

• Buy Now Pay Later

• Business lending

• B2B payments

It’s finance through Shopify, not the bank

You can read more of our embedded finance use cases here

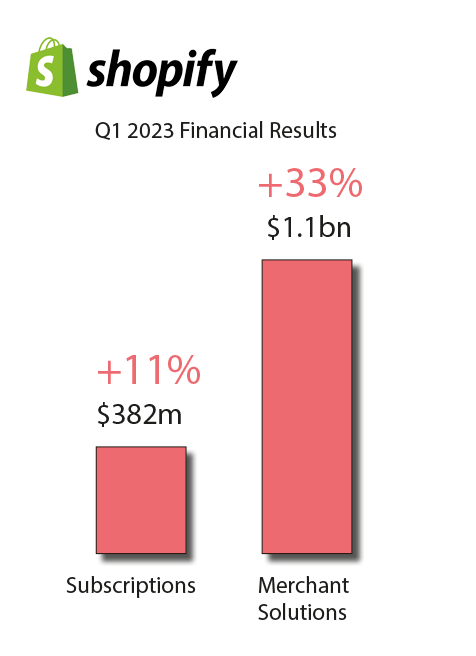

6. How embedded finance enhances the workplace

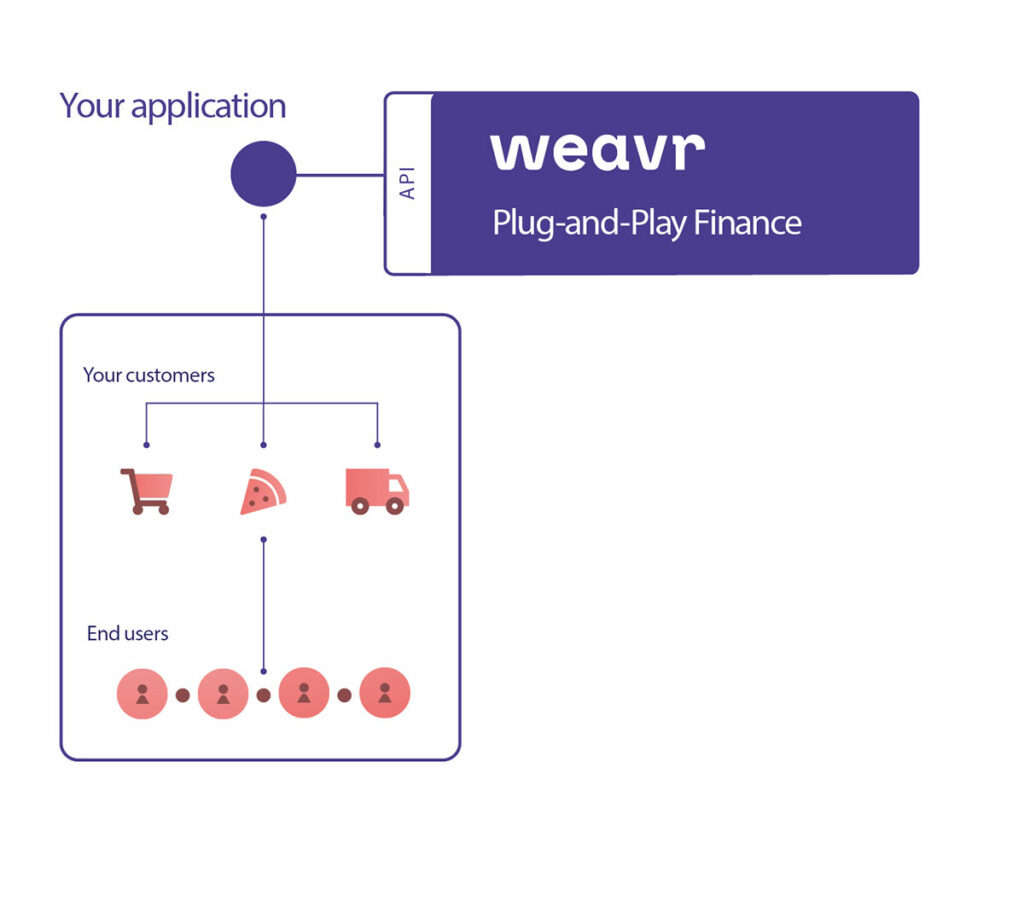

This diagram demonstrates how adding financial services to the new generation of digital workplace platforms empowers employees.

Employers want employees to be empowered and motivated but often lack the means to give them easy-yet-controlled access to the company’s money. They also struggle to empower employees to purchase the stuff they need for their work, the benefits that they actually want as well as the occasional rewards for being awesome.

For SaaS applications it’s becoming more important to bring together everything needed to support employee-directed financial transactions – embedded finance helps with this.

Your SaaS platform for employee interactions can turn finance from a friction into a winning feature. But, there’s a significant hurdle to overcome.

Compliance headaches

While offering access to financial services to employees within an application is compelling, the resources required are prohibitive and dauntingly complex whether you’re designing from scratch or adding features to your existing solution.

Then there’s the burden of compliance, regulation and data security that comes with it all.

What if there was another, less stressful way?

7. The fastest and easiest way to embed finance is with Plug-and-Play Finance

The next generation of embedded finance, Weavr gives you the ability to supercharge your business with Financial Plug-ins.

Core to Plug-and-Play Finance is the understanding that our customers will be better equipped than any payment provider to create solutions to real-world challenges. It’s then Weavr’s role to give easy enough financial-services tools to augment their proposition. A key aspect of Weavr’s mission is to enable any digital application to integrate financial services that can create value for customers. The result? Improved customer experience is great for users of the application. For the business, they also have the opportunity to multiply their revenues.

Weavr’s Plug-and-Play Finance gives your business the ability to design and launch products at short notice, which is essential in today’s fast-paced world. That’s not the only benefit, Weavr is the fastest and most cost-effective option for any business wishing to embed finance and validate its impact.

Faster to build

Gain immediate access to the complete package you need for your business model, so you can get to your first live transaction 10x faster than any other approach.

Easier to run

Secure, scalable SaaS platform behind unified interfaces means you can run and grow your business without worrying about building your own fintech ops team.

Designed to evolve

Weavr plug-ins help you stay agile with clear versioning and change management, and new fintech capabilities added regularly. Scalable including global product offering and automatically updated features with every launch.

Increased customer acquisition

85% of companies found embedding finance helped them acquire new customers.

Your brand takes credit

All Weavr solutions are 100% white-labelled, so you maintain ownership of the customer experience with no distractions or brand dilution.

8. Embedded finance for employee-directed applications

Weavr’s Employee Finance Plug-in

The Employee Finance Plug-in has been designed specifically to meet the requirements of innovators wanting to embed finance into employee benefits, expense management or related use cases. It brings together everything you need to support employee-directed financial transactions within a B2B SaaS application.

Once deployed, such an application can enable their business customers to onboard their team members, configure financial controls, manage employee payments and more.

Employees thus gain easy access to the benefits, rewards, commissions or any other payout their employee makes available to them.

Here are some of the capabilities it provides:

• Payment cards for employees: allow businesses in your platform to create payment cards that empower their employees to spend safely, embedded within a branded digital experience.

• Instant digital accounts: generate and connect accounts instantly, which can be used to hold segregated balances and budgets, fund payment cards, and transact programmatically.

• Safe, configurable rules: start with proven financial roles and rules out of the box and tailor details of currencies, spending limits, categories, and account relationships to suit your business.

• End-to-end UX inside your platform: create custom designs for virtual and plastic payment cards. All aspects of financial UX are yours to design so users associate their new fintech powers with your brand

• Offer features your competition can’t: attract new business signups and expand your loyal user base thanks to highly “sticky” finance features embedded within your app

8. Case Study: Embedded finance for an employee benefits platform

How can businesses with a benefits platform be better equipped to support talent acquisition and retention?

For Ben, the answer was to build an incredibly flexible, all-in-one, employee benefits platform. Now, any company can personalise the benefits they offer, whilst significantly reducing the associated admin and simultaneously increasing end-user satisfaction. Not to mention, it’s budget-friendly and fully automated.

Powered by Weavr, Ben implemented the Employee Finance Plug-in to provide:

• Branded benefits cards, enabling instant payments, that can be added to mobile wallets and limited to specific suppliers

• Controls for employers to manage the set of benefits provided to employees, e.g. gaining access to preferred rates on a wide selection of local and global insurance benefits

• Budget given to employees to pay for the benefits that most appeal to them

• Automatic payment reconciliation to remove the typical admin burden

“Weavr’s time-to-market cannot be beaten. For a young company that needs to get a product out quickly, there is no better solution”

Sebastian fallert – CEO, BEN

The solution

For employers, the platform makes supplying benefits packages on an international scale easier than ever before. Furthermore, Ben is the first fully automated benefits platform that integrates with a company’s current systems, such as Xero, HiBob, and Aviva pensions – among others.

Read the full case study here

Employee Benefits

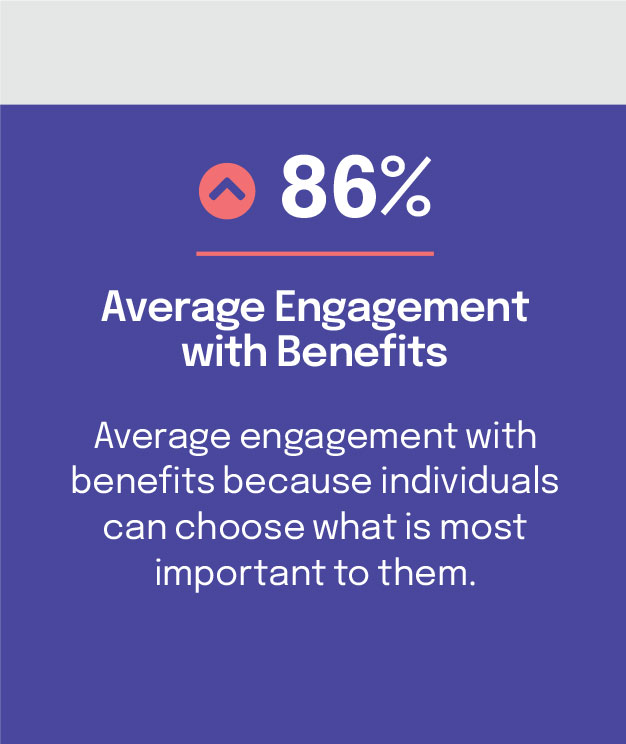

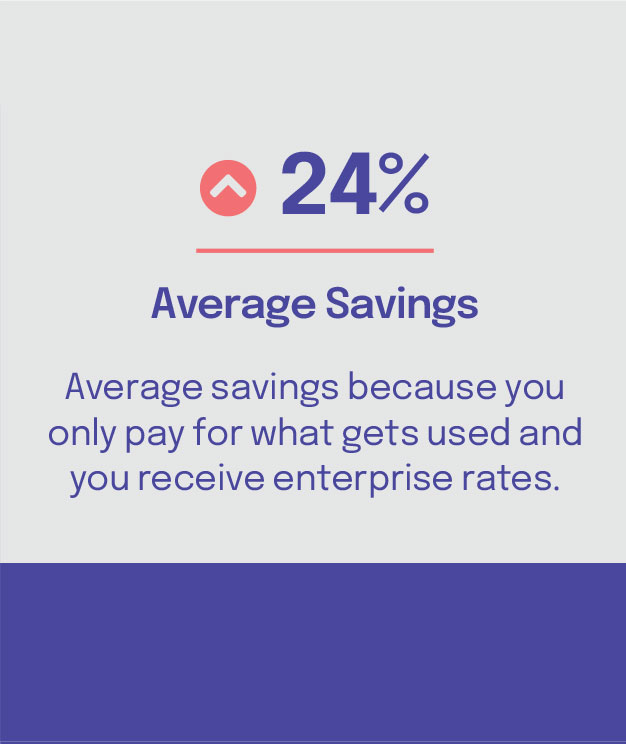

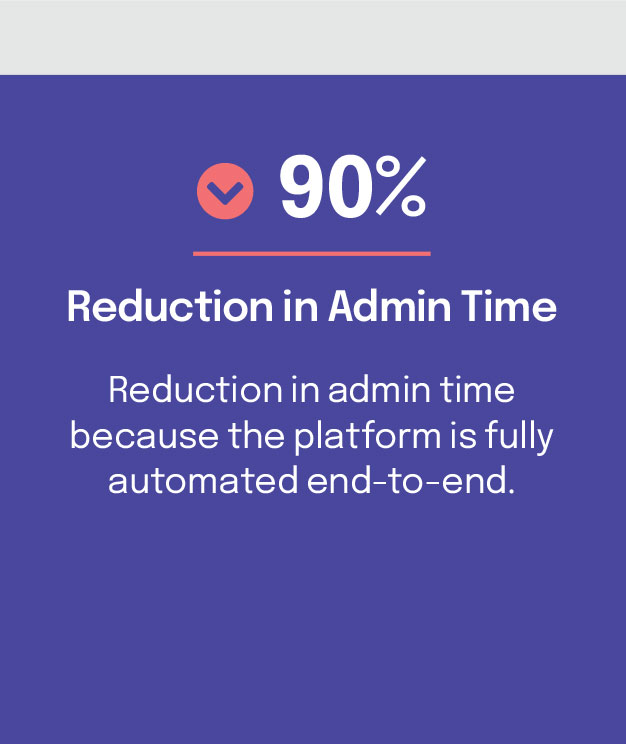

Companies who have implemented Ben for their employees have recorded incredible results:

9. What you need to build an embedded finance solution for your workplace application

In today’s fast-paced market, you should be able to easily, quickly and safely integrate banking features such as cards, accounts and IBANs into your UX and workflows. And with Weavr’s Plug-and-Play Finance, this has never been simpler because we provide a fully-formed solution to plug in.

How our simple plug-and-play solution fits perfectly into your application

10. What you get with Weavr’s plug-and-play embedded finance solution

Powerful financial capabilities

- Mastercard debit cards

- EUR, GBP and USD e-money accounts

- Domestic & international payments

- Fully configurable rules & limits

Differentiate and drive revenue

- Bring your own brand to the whole user experience including card designs

- Design your own billing models to monetise financial features in your app

Embedded finance essentials

- Due dillegence as a service with build-in secure self-service user onboarding

- Monitor transactions in near real-time

- Readymade analytics dashboards

Robust, scalable cloud platform

- Cloud-native platform: no additional hosting or compute charges

- Low latency, high performance at scale

- High availabilitiy & service monitoring

Developer friendly toolkit

- Open API, free to prototype in sandbox

- Mobile-first SDK with secure UI widgets

- Rapid release cycle for new features

- Free of charge APU calls in production

Embedded finance expertise

- Dedicated customer success manager

- 24/7 UK-based tier 2 tech and transactions support

- Proactive fraud prevention monitoring

If you found this guide to embedded finance in workplace applications informative why not download our guide to digitally empowered employees into B2B payment platforms or speak to one of our team today about how we can help you and your business?

Or perhaps you want to understand what is embedded finance in more detail? Then check out our ultimate guide to embedded finance.