Why is embedded finance a natural fit for digital companies? And how can you get started when there seem to be so many different financial solutions available?

Well, following on from the partnership announcement with NUMARQE, the London-based corporate-credit provider, we caught up with James Bowler, CEO and Co-Founder of NUMARQE to dive deeper into the why and how embedded finance works for them.

Tell us a little bit about NUMARQE

We’ve been running the company now for a couple of years and the premise of NUMARQE is to essentially help mid-market companies with their working capital management. To do that, we’ve built an all-in-one platform that really gives two key facets to the management of working capital: the first is liquidity (instant credit in multi-currency), and the second is the automated tools to utilise the credit and make corporate payments.

In short, our innovative credit platform harnesses the power of AI to enable real-time underwriting of credit risks, make intelligent lending decisions and efficiently allocate credit to our customers for all their corporate expenditure, while integrating with well-known accounting software.

And there are even more capabilities being launched soon.

The embedded finance opportunity

Why embedded finance for NUMARQE? And what opportunity does it enhance?

Essentially, we wanted a way to go to market with our credit products as quickly as possible.

We had our thesis around the mid-market being very underserved by traditional banks and lending players. I knew from my experience as a CFO for many, many years the pain points we encountered with obtaining credit and needing a much more efficient process to authorise and make payments globally.

We wanted to launch the corporate card product fast:

- To test whether the problem exists

- To meet the demand we anticipated from the target segment

- Then go on to scale

Rather than building all the inherent technology layers into a MasterCard or Visa network, which would have taken probably two or three years and would have required us to be regulated, we wanted to go to market as quickly as possible.

Embedded finance was the way for us to do that.

Weavr takes out all the hard work of accessing the cards infrastructure, so we could concentrate on building the front and back end and the lending decisioning part, which is our IP, and we use your platform to be able to sync into the wider banking network and enable us to have a live product in just six months.

What research did you do when realising embedding finance was the option for NUMARQE?

We spoke to many providers on the street that have a Banking-as-a-Service (BaaS) or Compliance-as-a-Service (CaaS), both US and UK companies.

It was apparent that most of the setups were for corporate cards with a debit feature, or a prepaid feature only, which wasn’t applicable to us. In principle the architecture worked, but the way their infrastructure was designed they couldn’t accommodate the credit model into their build.

The compliance set-up of Know You Business (KYB) was a vital factor for us too, other providers we spoke to didn’t offer the specific KYB options we needed as Weavr does.

We found the other companies had a take-it-or-leave-it approach and therefore, they weren’t overly accommodating or flexible to our needs.

Why did you choose Weavr?

Following on from the elements of functionality, suitability and the matching up to NUMARQE’s business needs, there were other reasons why we chose Weavr’s embedded finance over and above others we’d researched.

We really liked your team. They’re very attentive in all the calls and they made a lot of effort to help us spec out what the right architectural flows would be. The attentiveness of Weavr versus other providers was vastly different. Weavr gave us that confidence level from day one.

Cost-effective as well which is obviously helpful.

There was a reciprocated desire to be long-term partners, where our growth supports Weavr’s growth and vice versa which feels mutually beneficial. The more features you offer us, the more we can offer our customers.

We’ve got big ambitions and want to make sure what we build is right for our market first time, not over time. Weavr are aligned with our passion.

The embedded finance solution

What problem is NUMARQE looking to solve for customers?

Similarly to what we covered in the previous section, we’re solving the working capital conundrum for mid-market corporations so they can have liquidity when they need it. For instance, making payments and meeting their obligations, but also the tools to spend in a thoroughly efficient and automated process that all works in one place.

Thinking back to my previous experience of being a CFO, we would have to source credit lines from different banks. Also, we’d have to source corporate cards from different providers too, depending on things like the geography of the business – it might be American Express in the US or Barclaycard in the UK and a completely different provider in Asia. As you can imagine, all these different providers have different back-end systems to work through, not to mention all the different currencies when dealing with a global business set-up.

There was this whole problem that I faced in my career around corporate cards in itself, but also struggling to get credit lines. We’re trying to bring everything into one platform, so the key problem we’re solving is providing unsecured credit lines, which is very rare these days.

Unsecured committed credit lines are virtually non-existent now from banking providers, yet are essential to the working capital management of corporates. The mid-market segment, where there are established profitable companies, not quite enterprise level (yet), are neglected as a customer base by the incumbent banks.

From NUMARQE’s research, there is a need for robust credit lines and every finance director you ever talked to has been talking about digitalisation for the last 15 years! So to be able to bring them a real-time digitised platform at their fingertips to manage their spend through that credit line creates a massive benefit to their working capital management.

That’s the problem we’re looking to solve, all those disparate components of:

- Obtaining credit

- Having to use different platforms

- Having multiple sign-offs

- Accessing multiple currencies to make payments

- All the manual reconciliations and paper form filling, etc.

NUMARQE take all the stress and hassle out of that by having an all-in-one platform to capture “when do I need the credit?”: it’s drawn down instantly and then allocated to the spending tools and to users/employees – it’s immediate, it’s visible, it’s all signed off and auditable, it’s all reconciled, it’s seamless.

With Weavr’s Plug-and-Play Finance, we can now…

We’ve built that first spending tool, which is the corporate cards with a credit line provided by NUMARQE, so now we can allow our customers to instantly onboard their users and spend in multiple currencies, which is key.

We’ve got the capability for virtual cards, lots of companies want virtual cards for online spending or subscriptions and there’s also the physical cards for the sales teams and the exec teams that are travelling. We can now offer all this to our customers.

Then the other things I think are really powerful are all the spending controls, Weavr has secured high spending limits. Mid-market companies will spend high amounts of expenditure in one transaction, having those limits available is a unique selling point for NUMARQE.

Having those limit controls at our disposal, for example, maximum transaction value limit or MCC code limit, or aggregate spend limits – these things are fundamental to our customer base.

The ability to facilitate virtual or physical cards, controls and processes very, very quickly with Weavr.

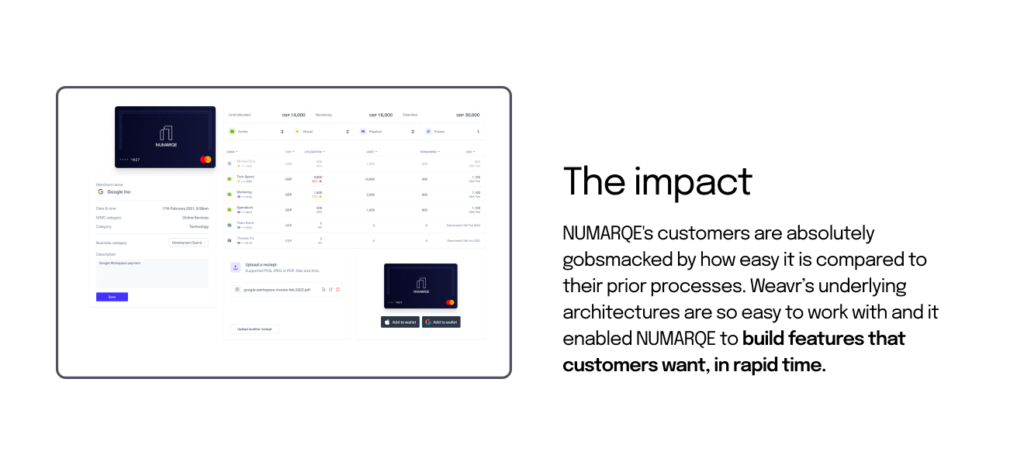

Our customers are absolutely gobsmacked by how easy it is compared to their prior processes.

The embedded finance impact

How has (or will) Weavr impacted your business growth/metrics?

We were able to go from signing on the dotted line with Weavr to launching in just six months, that was a massive benefit for us – incredible. Especially as a lot of what we needed was bespoke to our business needs.

Being with Weavr has supported our business model and enabled us to service the right customer segments. In terms of growth, it’s about being able to offer things like onboarding fifty users in one go, imagine if you had to do that one by one?

NUMARQE’s users don’t need much training because of the way we’ve designed the products and the way it interacts with Weavr is so simple. This results in an increased speed of set-up for the end user – we’re looking at days, rather than weeks or months. Our customers are happy getting stuck in (almost) straight away.

Weavr’s underlying architectures are so easy to work with, it enabled us to build features that customers want, in rapid time.

Anticipated or real data we can share with the audience?

We’re consistently over-performing, in the sense that because the onboarding experience is so seamless, customers are immediately happy and motivated to spend. They are spending more than we thought they would and embedding our product into their processes far quicker than we anticipated. And we were confident before launching.

This has to be down to the ease of use and underlying technology and we feel strongly that we are solving a need for our customers – but we’re still surprised at how quickly things have progressed.

How does embedded finance make you money?

It’s allowing NUMARQE to have the product in the market which doesn’t have to be built or be regulated for ourselves, so implementing embedded finance has enabled us to buy versus build which saves us a lot of cost and time.

For us to do all of that without having an embedded finance provider like Weavr, would take us two years to be licensed, onboarding a payment processor, onboarding a card bureau, and have the right collateral requirements that the card providers would require we have.

We’re making money today because Weavr has been able to help us get to market in such a short time frame.

The more features the embedded finance provider offers, the more we can offer our customers and therefore more customers love us and it creates a positive reinforcement cycle of satisfied customers using NUMARQE more to spend through our credit lines.

The global potential of Weavr growing globally is massive for us. Other embedded finance firms are focused on Europe only, lacking the potential and ambition of Weavr.

Ultimately, how you make us money is giving us the platform to offer what we need to our customers in a pretty instantaneous way.

And what about the future?

We’re looking forward to launching new products using Weavr’s embedded finance technology, which is on the roadmap for this year and beyond.

The more product features Weavr introduces the better for NUMARQE as it keeps our customers all in one place, making it more seamless and easier from a user experience perspective.

Inspired by NUMARQE’s story? And want to discover more about what is embedded finance? Check the ultimate guide here.