FAQs

Book in with a Weavr expert.

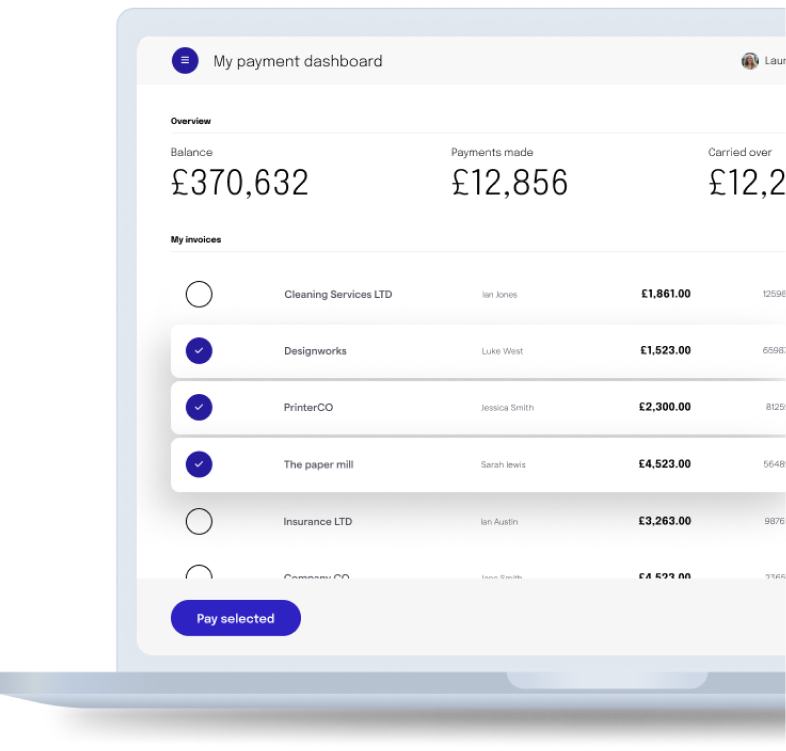

With Weavr, you can get from prototyping to live transactions in your app within five weeks. Because we’ve already taken care of putting together all the parts you need to integrate powerful financial features into your application, development time only depends on configuration, testing, and integration with your application stack. This allows our customers to get new applications into production in weeks, compared to the months or even years that it takes for businesses working with financial institutions and piecing together compliance, anti-fraud, and other required elements by themselves.

No prior banking or payments technology experience is needed in your team. Weavr’s mission is to make adding financial features to your applications as easy as plug-and-play. So we’ve done the heavy lifting on both the technology and regulatory complexities of building and running embedded finance, allowing you to focus on the innovative use cases you’re going to bring to market. The sky’s the limit!

Weavr is free to your developers to experiment with in our sandbox. Once you are ready to work on your live business applications, you’ll see our pricing is as simple as everything else you get from Weavr. We include as much as possible under single flat monthly fees that match your business stage, and allow you to calculate variable costs (e.g. per transaction fees) in a transparent manner. Please see our pricing overview here.

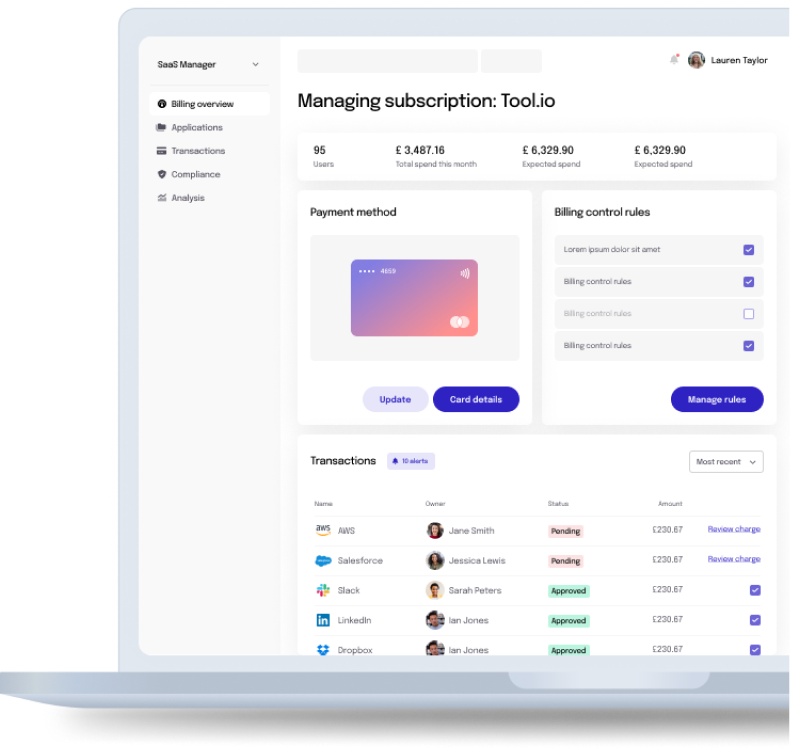

We don’t require your business to get its own licence as a regulated financial institution. Weavr plug-ins deliver you an immediately usable package of features which include built-in compliance. One important aspect of this is that your business does not need to handle sensitive financial data such as credit card numbers: our technology segregates this data securely while ensuring you can still customise the design and content of the user experience of financial workflows within your applications.

We are adding new features constantly, such as new payment methods, supported currencies and countries, authentication options, and fine-grained configuration controls. Core features are available as fast as you are ready to integrate them into your application’s workflows. Certain other features not core to plug-ins are available as add-ons to your subscription. If your business requires features that you can’t see in our plug-in, talk to us about our roadmap and support for custom embedded finance integrations.

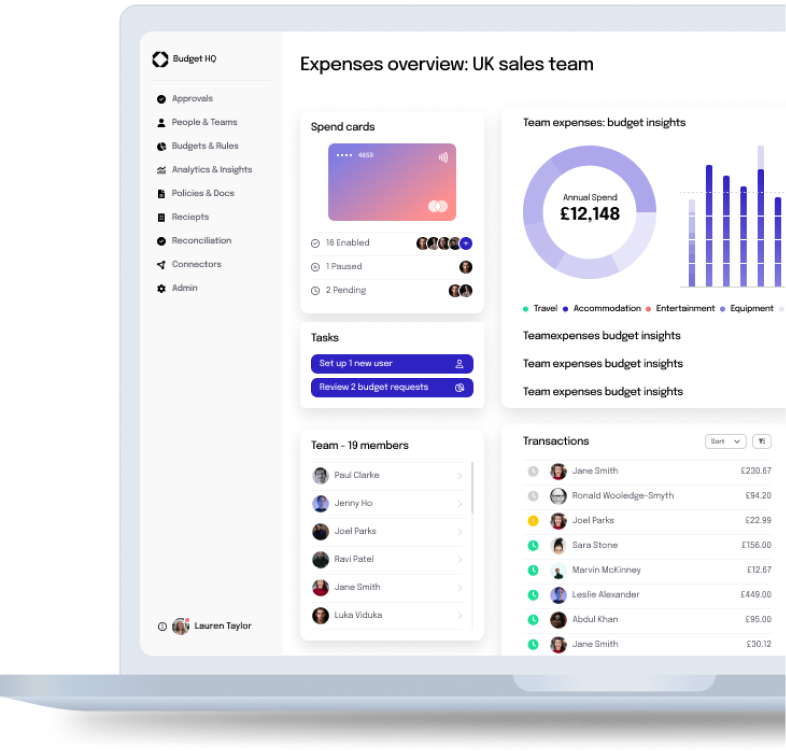

Your business will have access to a full range of data around user workflow steps and statuses, API usage, financial actions via webhooks, aggregated analytics, and flexible reporting options. We make this easy to track and report on via a built-in visual BI dashboard. We aim to give your product teams everything they need to know to gain insights into financial feature usage and customer success.

Developers can jump straight into our API documentation and free sandbox access. To discuss business requirements and your embedded finance innovation ideas, we’d love to talk.